Welcome to part two of our Nigerian Tax Series-focused Newsletter. If you missed the introduction to the series, you can access it here

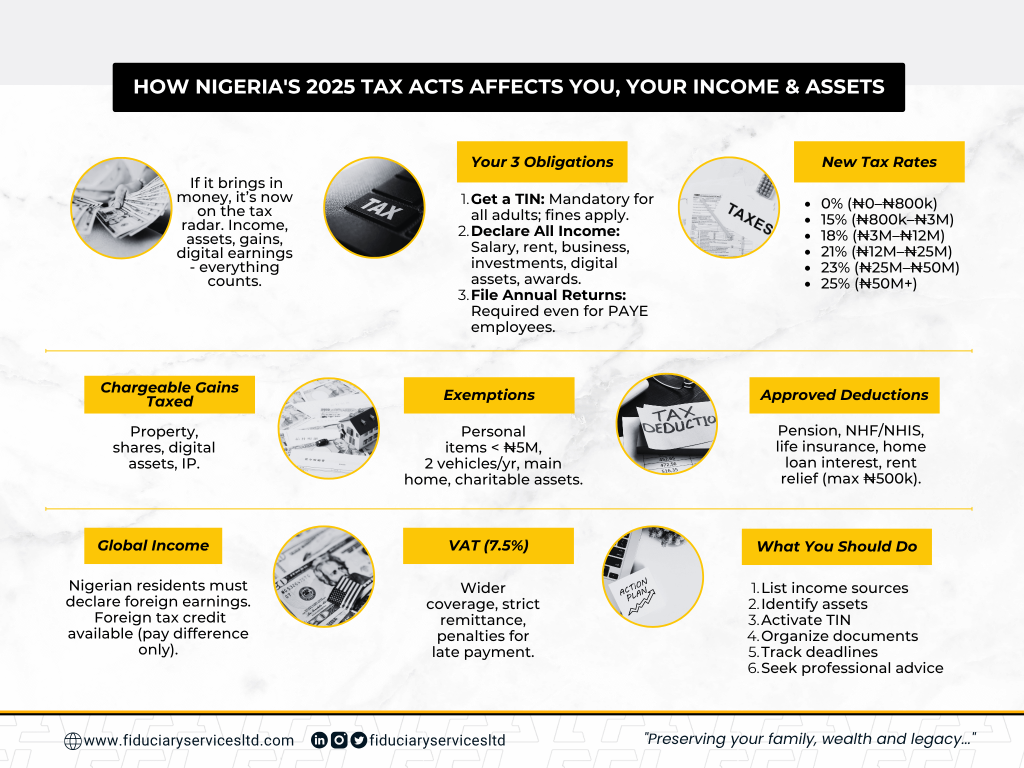

The 2025 Tax Acts represent one of the most significant shifts in Nigeria’s fiscal landscape in over a decade, reshaping how personal income, wealth, and cross-border assets are viewed and taxed. This Tax series explores what these changes mean for individuals, those whose financial affairs extend beyond salaries to encompass investments, property holdings, digital assets, and family enterprises.

A Simple Illustration

When Ada received a ₦1,000,000 (One Million naira) innovation grant, she was elated, until her tax adviser asked whether she had declared it. That simple question captures the essence of the 2025 Tax Acts; if it brings in money, it’s on the tax radar. Whether you earn a salary, freelance, run a small business, invest in property, or trade digital assets, you now have tax obligations tied to your earnings.

First Obligation

The first obligation is registration and identification. Every adult must now obtain a Tax Identification Number (TIN), and failure to do so attracts a fine of ₦50,000 initially and ₦25,000 for each month thereafter. Your TIN must appear on all filings, correspondence, and financial documents, including contracts with banks, insurers, and government bodies. In fact, financial institutions are now required to confirm that clients have valid TINs before any transaction can proceed. In effect, your TIN has become the passport to your financial world.

Second obligation

The second obligation is income declaration. Under this regime, everyone earns and everyone pays. For employees, taxes continue to be deducted under the Pay As You Earn (PAYE) system, while entrepreneurs, freelancers, investors, and those with diversified portfolios must self-declare their income, covering profits, rents, dividends, royalties, awards, digital assets, and even competition winnings. If you fall under any or all of these categories, proper recordkeeping is now essential, especially if you have multiple income streams. Delays, underreporting, or failure to file now attract compounded interest, penalties, and in serious cases, prosecution.

Progressive System

Some of the recent controversy has centred on the new tax rates, but in reality, the system is progressive, meaning that the more you earn, the more you contribute. Individuals earning up to ₦800,000 annually are exempt, while income above that is taxed in bands ranging from 15% up to 25% for those earning over ₦50 million a year. The goal is to ensure fairness: lower earners pay less, and higher earners pay proportionally more.

Chargeable Gains

Beyond income tax, the Acts now extend taxation to chargeable gains on the disposal of property in or outside Nigeria, including real estate, shares, digital or virtual assets, and intellectual property. However, there are notable exemptions: personal items below ₦5 million, up to two vehicles per year, your main home, and assets held for charitable or cooperative purposes are excluded. The gains from taxable disposals are then charged at the same rates as your personal income.

Allowable deductions

To maintain balance and fairness, the law also recognizes a number of personal deductions. You can claim reliefs for pension, NHF, and NHIS contributions, life insurance or annuity premiums, interest on personal home loans, and rent relief of up to 20%, capped at ₦500,000 however these can only be claimed with proper documentation. For instance, if you earn ₦10 million annually and claim ₦1 million in eligible deductions, you’ll be taxed on ₦9 million; your net taxable income.

Global Income/Revenue

A notable housekeeping concern is the introduction of global income taxation for residents. If you live in Nigeria but earn income abroad, perhaps through remote work, digital consulting, or foreign investments, those earnings must now be declared in Naira. To prevent double taxation, the law allows a foreign tax credit, meaning you can offset tax already paid abroad, but only up to the lower of the two applicable rates. For example, if you earned ₦2.2 million in Ghana and paid 10% tax there, but Nigeria’s rate is 15%, you’ll only need to pay the 5% difference locally.

Value Added Tax

The law also strengthens Value Added Tax (VAT) compliance. VAT remains at 7.5%, applies to a wider range of goods and services, and everyone who supplies taxable goods or services must collect and remit it. All individuals are now required to file annual tax returns, even for employees whose employer has already deducted PAYE. Failure to keep proper records may lead to presumptive taxation, allowing authorities to estimate your income and tax you accordingly. Late payments are especially costly, attracting a 10% penalty on the unpaid amount, plus compounded interest at the Central Bank of Nigeria’s Monetary Policy Rate plus a ministerial spread for Naira payments, or the Secured Overnight Financing Rate (SOFR) plus 10% for foreign currency remittances.

Practical Practice

So, what does all this mean for you in practical terms? It’s time to treat your tax affairs like personal housekeeping. Begin by listing all your sources of income; employment, business, and investments, and identifying the assets you own, whether real estate, shares, digital tokens, or trusts. Review your documentation, confirm that your TIN is active, and ensure you are properly identified as a taxpayer. The tax system is moving toward greater traceability, so proactive organization will save you from future headaches. Monitor filing deadlines, keep comprehensive records, and seek professional advice if your situation involves cross-border assets, complex structures, or family wealth.

The 2025 Tax Acts have redrawn the lines of personal financial responsibility, ushering in an era that rewards transparency, discipline, and early compliance. Whether you are an employee, entrepreneur, or investor, maintaining good fiscal housekeeping is no longer optional; it is the key to staying compliant and financially secure.

In the second part of this series, we turn our focus to family enterprises, where we will examine how the 2025 Tax Acts are reshaping the way family-owned businesses navigate the new tax realities and the actions to be taken to preserve their values and wealth.

Tax rate | Income range | Annual Taxable Income | Monthly income Equivalent |

0% | ₦0 to ₦800,000 | ₦0 to ₦800,000 | ₦0 to ₦66,667 |

15% | Next ₦2,200,000 | ₦800,001 to ₦3,000,000 | ₦66,668 to ₦250,000 |

18% | Next ₦9,000,000 | ₦3,000,001 to ₦12,000,000 | ₦250,001 to ₦1,000,000 |

21% | Next ₦13,000,000 | ₦12,000,001 to ₦25,000,000 | ₦1,000,001 to ₦2,083,333 |

23% | Next ₦25,000,000 | ₦25,000,001 to ₦50,000,000 | ₦2,083,334 – ₦4,166,667 |

25% | above ₦50,000,000 | ₦50,000,001 above | Above ₦4,166,667/month |

As part of our Wealth Preservation services, we have experienced Advisors ready to assist you in developing an estate plan that protects, preserves, and sustains you and your family’s wealth for generations.

Get in touch with one of our professionals today by sending an email to contact@fiduciaryservicesltd.com.