Your Estate Your Tax: Everything Concerning You, Your Family, Your Business and The Tax-Man

Era of Transparency: Nigeria’s Redefined Tax Regime

For individuals, enterprises, and families building wealth, the real challenge isn’t just how much is your income or what you earn; it’s also being intentional about how much you keep, how well you protect it, and how you pass it on.

So, when Mr. Ade, a Lagos-based investor and second-generation business owner, sat down with his estate planning advisor at the end of Q3 2025, he had one pressing question:

“I’ve diversified my assets globally for years. How will the new Nigerian tax laws affect these assets and what I’ve built for my children?”

His question captures what many discerning individuals and families across Nigeria are asking today.

We are excited to start a series on the Nigerian Tax Regime with the theme “Era of Transparency: Nigeria’s redefined Tax Regime”.

Our aim is to highlight the key provisions of the Tax Regime and what they mean for your personal wealth, your family structures, your businesses, and the assets you hold both locally and offshore.

We like to say that the recent enactment of the Nigerian Tax Act (NTA) 2025 and the Nigerian Tax Administration Act (NTAA) 2025 has ushered in a new era, one that reshapes how wealth, business, and global income are defined and taxed. These New Acts represent the most comprehensive tax reforms Nigeria has seen in decades, setting a new standard for fairness, inclusiveness, and compliance.

Key Highlights of the 2025 Tax Acts

• Unified and Modernized Tax Framework: The NTA 2025 consolidates major tax laws, from Personal and Company Income Tax, Value Added Tax (VAT), Stamp duty to Capital Gains and others into one cohesive framework. The NTAA 2025 complements it with digital filing, electronic record keeping, and simplified compliance procedures.

• Digital Transformation: Mandatory Tax Identification Numbers (TINs), electronic filing systems, and digital records are now part of everyday compliance. Whether carrying out transactions or registering property, a TIN is now indispensable. This approach enhances efficiency while reducing fraud and manual bottlenecks.

• Fairness and Inclusiveness: From salaried employees to family businesses, freelancers, and digital creators, everyone is now included in the tax net. The new regime promotes equity by broadening participation, determining tax rates according to earnings and closing long standing loopholes.

• Global Reach: Under the NTA 2025, Nigerian residents are taxed on worldwide income. That means income earned abroad, from investments, property, or remote work must be declared locally. However, double taxation is mitigated through foreign tax credits and international cooperation, aligning Nigeria with global tax norms.

• Recognition of Family, Trust, and Estate Structures: Trusts, estates, and family-owned assets and companies are expressly included in the new framework. Trustees, settlors, and beneficiaries of both local and offshore trusts must comply with clear reporting obligations and family enterprises must also register, file annual returns, and maintain transparent records to preserve credibility and continuity.

• Recognition of Digital and Virtual Assets: The Acts officially bring digital assets such as cryptocurrencies, tokens, and NFTs into the taxable ecosystem. Gains from their sale or transfer now fall under capital gains tax, reflecting how wealth has evolved beyond physical assets.

• Clarity for Businesses and Multinationals: The law redefines what constitutes a Nigerian company, extending tax obligations to businesses managed or controlled from Nigeria, even if incorporated elsewhere. A 15% minimum effective tax rate (ETR) now applies to large multinationals, aligning Nigeria with OECD global standards. For compliant businesses, these measures foster credibility and attract investment.

The Series will unpack specific provisions (in different parts) as affects individual and family tax planning to digital assets, trusts, and corporate structures, so you can stay ahead, compliant, and strategically positioned.

PART 2

Welcome to part two of our Nigerian Tax Series-focused Newsletter.

The 2025 Tax Acts represent one of the most significant shifts in Nigeria’s fiscal landscape in over a decade, reshaping how personal income, wealth, and cross-border assets are viewed and taxed. This Tax series explores what these changes mean for individuals, those whose financial affairs extend beyond salaries to encompass investments, property holdings, digital assets, and family enterprises.

A Simple Illustration

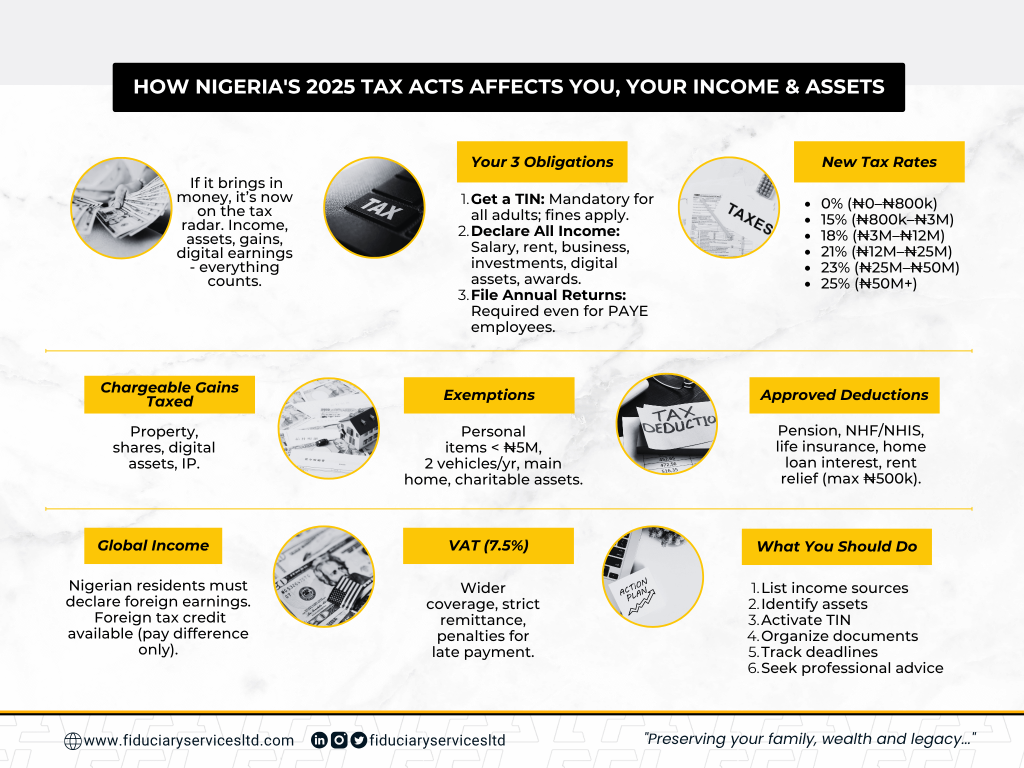

When Ada received a ₦1,000,000 (One Million naira) innovation grant, she was elated, until her tax adviser asked whether she had declared it. That simple question captures the essence of the 2025 Tax Acts; if it brings in money, it’s on the tax radar. Whether you earn a salary, freelance, run a small business, invest in property, or trade digital assets, you now have tax obligations tied to your earnings.

First Obligation

The first obligation is registration and identification. Every adult must now obtain a Tax Identification Number (TIN), and failure to do so attracts a fine of ₦50,000 initially and ₦25,000 for each month thereafter. Your TIN must appear on all filings, correspondence, and financial documents, including contracts with banks, insurers, and government bodies. In fact, financial institutions are now required to confirm that clients have valid TINs before any transaction can proceed. In effect, your TIN has become the passport to your financial world.

Second obligation

The second obligation is income declaration. Under this regime, everyone earns and everyone pays. For employees, taxes continue to be deducted under the Pay As You Earn (PAYE) system, while entrepreneurs, freelancers, investors, and those with diversified portfolios must self-declare their income, covering profits, rents, dividends, royalties, awards, digital assets, and even competition winnings. If you fall under any or all of these categories, proper recordkeeping is now essential, especially if you have multiple income streams. Delays, underreporting, or failure to file now attract compounded interest, penalties, and in serious cases, prosecution.

Progressive System

Some of the recent controversy has centred on the new tax rates, but in reality, the system is progressive, meaning that the more you earn, the more you contribute. Individuals earning up to ₦800,000 annually are exempt, while income above that is taxed in bands ranging from 15% up to 25% for those earning over ₦50 million a year. The goal is to ensure fairness: lower earners pay less, and higher earners pay proportionally more.

Chargeable Gains

Beyond income tax, the Acts now extend taxation to chargeable gains on the disposal of property in or outside Nigeria, including real estate, shares, digital or virtual assets, and intellectual property. However, there are notable exemptions: personal items below ₦5 million, up to two vehicles per year, your main home, and assets held for charitable or cooperative purposes are excluded. The gains from taxable disposals are then charged at the same rates as your personal income.

Allowable deductions

To maintain balance and fairness, the law also recognizes a number of personal deductions. You can claim reliefs for pension, NHF, and NHIS contributions, life insurance or annuity premiums, interest on personal home loans, and rent relief of up to 20%, capped at ₦500,000 however these can only be claimed with proper documentation. For instance, if you earn ₦10 million annually and claim ₦1 million in eligible deductions, you’ll be taxed on ₦9 million; your net taxable income.

Global Income/Revenue

A notable housekeeping concern is the introduction of global income taxation for residents. If you live in Nigeria but earn income abroad, perhaps through remote work, digital consulting, or foreign investments, those earnings must now be declared in Naira. To prevent double taxation, the law allows a foreign tax credit, meaning you can offset tax already paid abroad, but only up to the lower of the two applicable rates. For example, if you earned ₦2.2 million in Ghana and paid 10% tax there, but Nigeria’s rate is 15%, you’ll only need to pay the 5% difference locally.

Value Added Tax

The law also strengthens Value Added Tax (VAT) compliance. VAT remains at 7.5%, applies to a wider range of goods and services, and everyone who supplies taxable goods or services must collect and remit it. All individuals are now required to file annual tax returns, even for employees whose employer has already deducted PAYE. Failure to keep proper records may lead to presumptive taxation, allowing authorities to estimate your income and tax you accordingly. Late payments are especially costly, attracting a 10% penalty on the unpaid amount, plus compounded interest at the Central Bank of Nigeria’s Monetary Policy Rate plus a ministerial spread for Naira payments, or the Secured Overnight Financing Rate (SOFR) plus 10% for foreign currency remittances.

Practical Practice

So, what does all this mean for you in practical terms? It’s time to treat your tax affairs like personal housekeeping. Begin by listing all your sources of income; employment, business, and investments, and identifying the assets you own, whether real estate, shares, digital tokens, or trusts. Review your documentation, confirm that your TIN is active, and ensure you are properly identified as a taxpayer. The tax system is moving toward greater traceability, so proactive organization will save you from future headaches. Monitor filing deadlines, keep comprehensive records, and seek professional advice if your situation involves cross-border assets, complex structures, or family wealth.

The 2025 Tax Acts have redrawn the lines of personal financial responsibility, ushering in an era that rewards transparency, discipline, and early compliance. Whether you are an employee, entrepreneur, or investor, maintaining good fiscal housekeeping is no longer optional; it is the key to staying compliant and financially secure.

In the second part of this series, we turn our focus to family enterprises, where we will examine how the 2025 Tax Acts are reshaping the way family-owned businesses navigate the new tax realities and the actions to be taken to preserve their values and wealth.

Tax rate | Income range | Annual Taxable Income | Monthly income Equivalent |

0% | ₦0 to ₦800,000 | ₦0 to ₦800,000 | ₦0 to ₦66,667 |

15% | Next ₦2,200,000 | ₦800,001 to ₦3,000,000 | ₦66,668 to ₦250,000 |

18% | Next ₦9,000,000 | ₦3,000,001 to ₦12,000,000 | ₦250,001 to ₦1,000,000 |

21% | Next ₦13,000,000 | ₦12,000,001 to ₦25,000,000 | ₦1,000,001 to ₦2,083,333 |

23% | Next ₦25,000,000 | ₦25,000,001 to ₦50,000,000 | ₦2,083,334 – ₦4,166,667 |

25% | above ₦50,000,000 | ₦50,000,001 above | Above ₦4,166,667/month |

PART 3

Welcome to Part 3 of our Tax Series focused on the taxation of Family Business Enterprises.

For many successful families, the family business is more than a commercial venture; it is a legacy that carries identity, history, and continuity across generations. But as Nigeria’s fiscal landscape evolves, even legacies must adapt. The 2025 Tax Acts have introduced significant changes that will reshape how family-owned enterprises are structured, taxed, and sustained, and understanding these changes is essential to preserving both value and reputation.

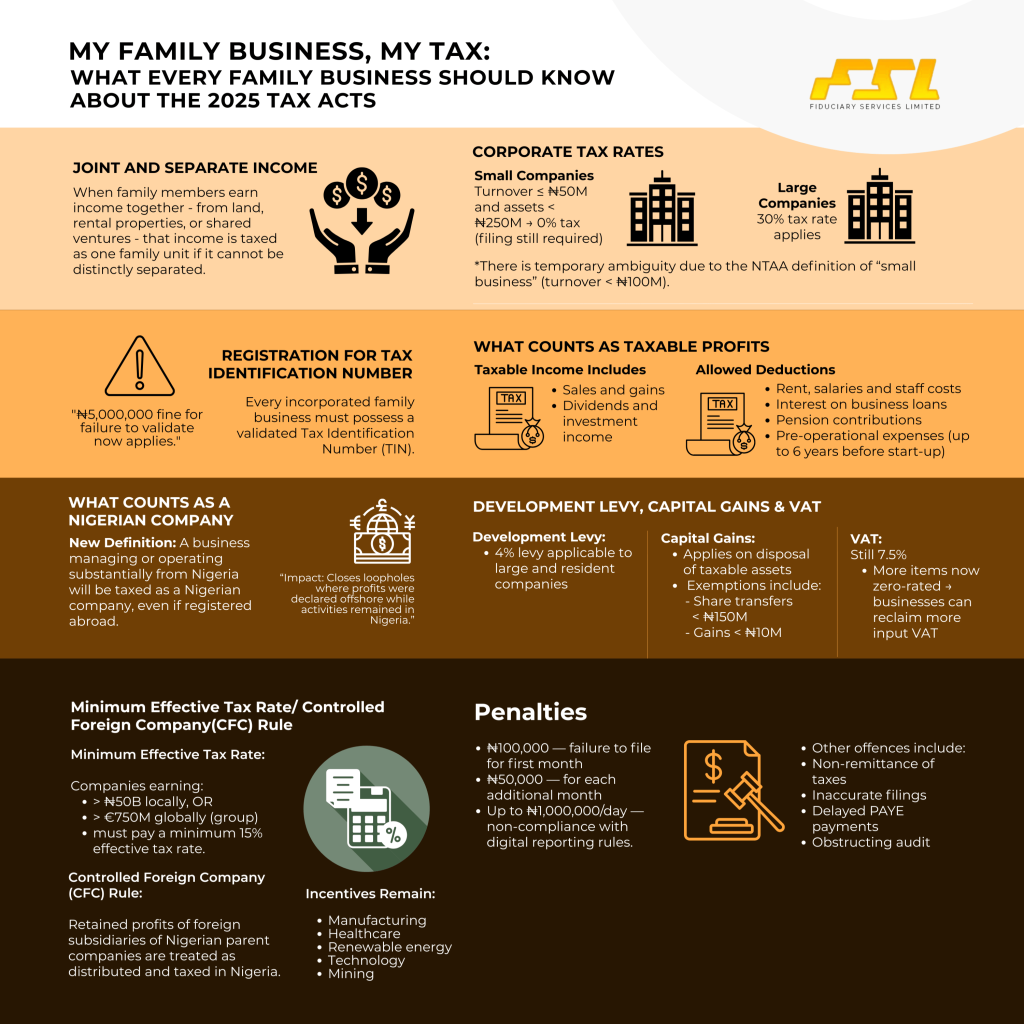

Joint and Separate Income

Family enterprises are unique because business and personal interests often intertwine. Under the new regime, where family members jointly earn income, for instance, from family land, rental properties, or a shared venture, and those earnings cannot be distinctly separated, the income will now be treated as family income and taxed as one unit.

However, income from inherited property, shares, or investments remains exempt from this family classification until it is distributed to individual members, at which point each person assumes responsibility for their portion. It is a fine but important distinction, designed to ensure fairness and transparency.

Registration for Tax Identification Number

For incorporated family businesses, compliance begins with registration. Every company must possess a Tax Identification Number (TIN), now automatically issued by the Corporate Affairs Commission upon registration. However, validation remains the company’s responsibility. Ignoring this step attracts a fine of ₦5,000,000, a reminder that tax identity is now as vital as legal incorporation. The TIN must appear on all correspondence, filings, and business documents, and financial institutions, brokers, and insurers are equally bound to reject transactions without it. It is also now an offence for a company to award a contract to a person without a Tax ID.

Definition of a Nigerian Company

Another significant shift in the Acts concerns what qualifies as a Nigerian company. Even if a business is registered abroad, if its management or core operations occur in Nigeria, it will now be taxed as a Nigerian company. This redefinition closes the long standing loopholes that once allowed profits to be booked offshore while operations remained onshore.

Tax Rates

As for corporate tax rates, the Acts take a tiered approach. Companies with annual turnover of ₦50 million or less and assets under ₦250 million qualify as small companies and enjoy a 0% tax rate, though they must still file returns. Larger entities pay 30% on profits. Some ambiguity remains, however, as the Tax Administration Act (NTAA) 2025 defines “small businesses” differently, as those with turnover below ₦100 million, though this is pending further regulatory clarification. What is certain, however, is that professional service firms, regardless of income level, no longer qualify for small company relief and must pay the full tax rate.

Taxable Profits and Deductions

Furthermore, in determining taxable profits, companies must compute income from all sources: sales, gains, dividends, and then deduct eligible business expenses. The Acts allow deductions for rent, staff costs, interest on business loans, pensions, and legitimate pre-operational expenses incurred within six years before start-up. Even corporate generosity is recognized: donations to approved charitable, educational, or public institutions qualify for deductions of up to 10% of profit before tax, while non-cash donations may also qualify for a deduction at the lower of the cost price of the item at the time of purchase or prevailing market value. Research and Development (R&D) expenditure remains deductible up to 5% of turnover, rewarding innovation within the private sector. Personal or unrelated expenses, however, remain strictly excluded. Only expenses that directly enable income generation count toward reliefs. The law’s intent is clear: profits must reflect true business performance, not personal spending disguised as operations.

Development Levy, Capital Gains and Value Added Tax (VAT)

Beyond corporate tax, development and capital gains obligations also apply. Large and Resident companies must now pay a 4% Development Levy, and all companies pay chargeable gains on disposals of assets that attract tax, except for the sale of shares below ₦150 million or where the gain is under ₦10 million. The Value Added Tax (VAT) rate remains 7.5%, but the list of zero-rated items has been expanded, allowing qualifying businesses to recover more input VAT.

Minimum Effective Tax Rate/ Controlled Foreign Company(CFC) Rule

For groups with multinational operations, the landscape has become even more sophisticated. The Acts introduce a 15% minimum effective tax rate for companies earning over ₦50 billion locally or €750 million globally. In effect, if your foreign subsidiaries pay less tax abroad, your Nigerian group must make up the difference, aligning with global tax reforms designed to prevent profit shifting to low-tax jurisdictions.

In addition, the Controlled Foreign Company (CFC) rule now deems retained profits of foreign subsidiaries of Nigerian parent companies as distributed and therefore taxable, even when those profits have not been formally paid out. On the brighter side, companies in priority sectors such as manufacturing, renewable energy, healthcare, technology, and mining continue to benefit from tax holidays and other investment incentives, particularly where reinvestment supports local growth.

Penalties

The penalties for default of these rules are steep: ₦100,000 for the first month of failure to file, ₦50,000 for each subsequent month, and up to ₦1,000,000 daily for refusal to comply with digital reporting requirements. Non-remittance of taxes, inaccurate filings, or failure to cooperate with audits can also lead to other heavy fines or imprisonment.

Tax compliance for companies today goes beyond filing. Every company must now:

- Appoint a designated tax agent;

- File annual self-assessment returns within six months of its year-end or 18 months post-incorporation;

- Submit monthly VAT returns by the 21st of the next month;

- Adopt the new electronic fiscalisation system, ensuring transparent invoicing and data reporting;

- Report any changes in shareholding, ownership, or registered address;

- Disclose any tax planning arrangements to the authorities; and

- Remit PAYE and employee deductions promptly.

The message is unmistakable: tax compliance has become integral to governance. For family-owned enterprises, these laws are not merely administrative; they are structural. This requires not only understanding the statutory obligations but also leveraging available incentives, reliefs, and exemptions in a way that aligns with the family’s long-term vision. They require a thoughtful review of business processes, documentation, and intergenerational governance. As the fiscal environment grows more transparent, families that act early, updating records, reviewing entity structures, and engaging professional estate planners, tax, and legal counsels will be best positioned to preserve wealth while staying ahead of regulatory expectations.

In the next part of this series, we will explore how the 2025 Tax Acts shape the realities of the global Nigerian, examining the tax obligations of individuals and families with global assets, dual residencies, international business interests, and non-resident entities connected to Nigeria.

PART 4

Welcome to Part 4 of our Tax Series focused on the Global Nigerian: Making Sense of Diaspora Taxscape and Cross-Border Tax Obligations.

Nigerians are indeed global citizens with footprints scattered across earth. The new Nigerian tax regime via the 2025 Tax Acts recognises and embraces this reality.

Today’s Nigerians are entrepreneurs in London, professionals in Dubai, innovators in Toronto, and investors with properties, shares, and family interests across multiple jurisdictions. Yet, behind this global mobility lies an equally global responsibility, understanding how the new Nigeria Tax Acts 2025 (NTA 2025) reshape the fiscal identity of the Global Nigerian.

For the first time, Nigeria Tax regime via the 2025 Act clearly outlines when and how non-resident individuals and companies are liable to tax in Nigeria, resolving long-standing gaps in the taxation of cross-border, digital, and offshore transactions.

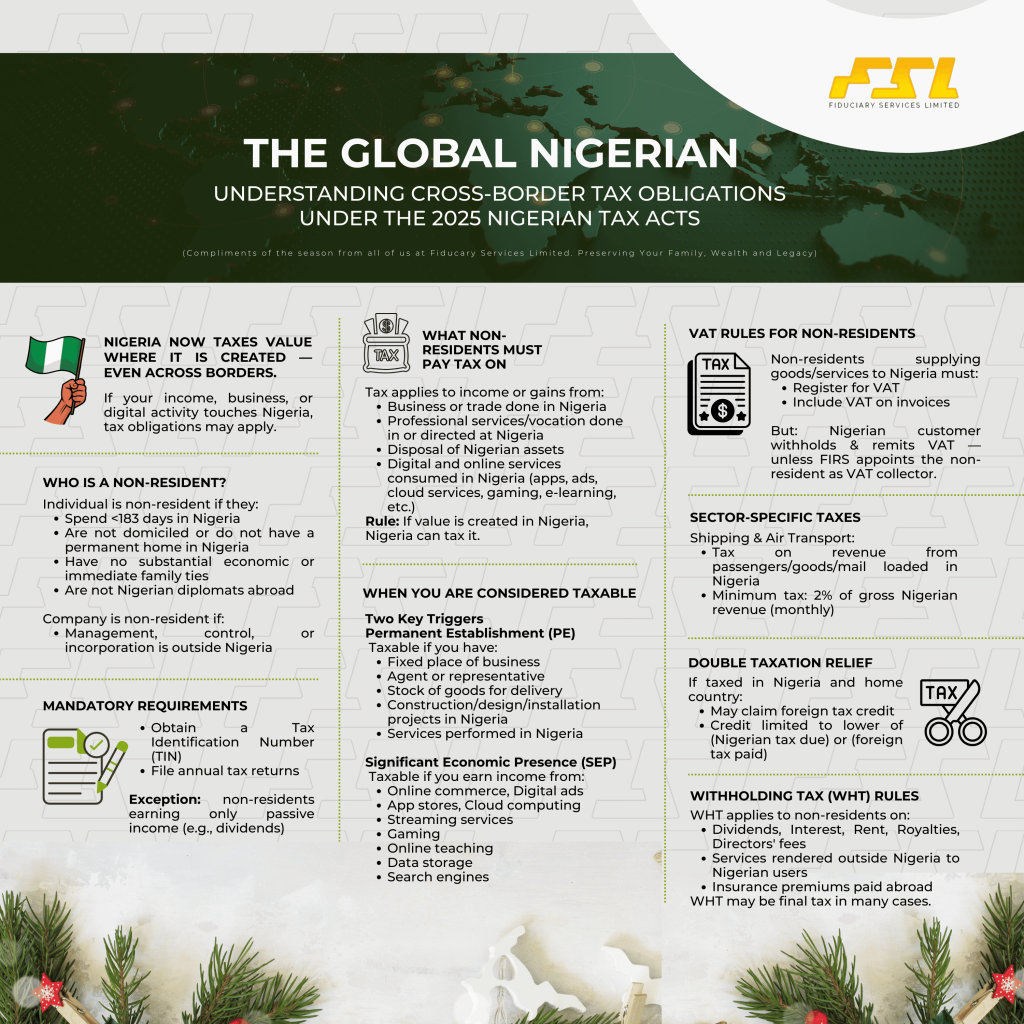

Definition of a non-resident person

At the heart of this Tax regime is a clear definition of who qualifies as a non-resident. The Act defines a non-resident to include any person, individual or company, depending on context.

For individuals, a non-resident is someone who, in any year of assessment, is not domiciled in Nigeria, has no permanent home or habitual abode in the country, has no substantial economic or immediate family ties to Nigeria, spends less than 183 days (approximately six months) in Nigeria within the year, and is not serving abroad as a Nigerian diplomat. A non-resident company is one whose management, control, or incorporation is outside Nigeria. In practice, this ensures that Nigerians who temporarily work or study abroad but maintain strong ties through family, property, or business remain within the scope of Nigerian tax obligations, while genuine foreign residents and entities are treated distinctly.

Tax Identification number and tax on income

Non resident companies and individuals are subject to tax on income or gains arising from any trade, business, profession, or vocation carried on in Nigeria, as well as chargeable gains on profits from the disposal of assets located or deemed located in Nigeria. This framework also extends to income from digital activities directed at Nigerian markets. This includes app stores, digital ads, streaming services, cloud storage, gaming, and e-learning platforms, reflecting the government’s effort to keep pace with the realities of a digital economy. The principle is simple: if value is created or derived from Nigeria, Nigeria has the right to tax it. They are also required to obtain a Tax Identification Number (TIN) and file annual returns except where they earn only passive income from investments such as dividends.

Permanent establishment and significant economic presence

To determine when the right to tax above arises, the Act introduces two key concepts; permanent establishment (PE) and significant economic presence (SEP). A non-resident is considered to have a permanent establishment where it maintains a fixed place of business or one available for its operations, operates through an agent or representative, keeps a stock of goods from which deliveries are made, participates in design, construction, installation, or similar projects in Nigeria, or provides services in Nigeria through employees, agents, or subcontractors.

The law also recognises that business today is not always physical. A significant economic presence arises when a non-resident engages in electronic or digital activities targeted at Nigeria and derives profits from them. This includes online commerce, app stores, cloud computing, digital advertising, social media, gaming, data storage, search engines, or online teaching. In such cases, even without a physical presence, the income earned is taxable in Nigeria.

This means that an app downloaded in Lagos, a webinar hosted in Abuja, or a cloud service billed to a Nigerian customer could create taxable presence even for a company based abroad. In effect, Nigeria has joined the global move to tax value where it is economically generated, not merely where servers or offices are located.

Taxation of profits from Non-residents

In determining the taxable profits for non-residents with PE or SEP, the profits of the PE or SEP are computed as a separate and individual company. The company tax rates applicable to Nigerian companies also apply to them, though they are exempt from payment of Development Levy.

The computed profits will include deductions for expenses calculated in naira, though royalties and management fees sent to the parent company will not qualify as deductions unless the actual cost is re-imbursed. It should also be noted that where the profits of the PE or SPE cannot be accurately determined, the tax authorities will calculate it for them. Also, the tax payable cannot be less than the amount withheld at source, and where withholding tax does not apply, a minimum of 4% of the total Nigerian income is imposed.

Withholding Tax (WHT)

The NTA 2025 retains Withholding Tax (WHT) as a key compliance mechanism for non-resident individuals and entities. Where income such as dividends, interest, rent, royalties, or directors’ fees is payable to a non-resident, tax is deducted at source by the Nigerian payer and may serve as final tax on such income. It can also serve as the final tax on payments for services rendered outside Nigeria to a Nigerian Resident or a Nigerian permanent establishment of a non-resident, as well as payments for insurance/insured risks from outside Nigeria. Payments made by Nigerian residents or Nigerian branches of foreign companies for services rendered from abroad are subject to tax, typically through withholding tax, except for employment contracts, teaching services, or expenses borne by a foreign branch of a Nigerian resident.

Value Added Tax

All non-resident individuals and entities who supply goods and services to Nigeria are mandated to register for VAT and include it on all their invoices. However, the VAT will be collected at source by the Nigerian customer and remitted to the tax authorities on their behalf. The exemption to this is where the tax authorities appoint the non-resident supplier as a VAT collector. Non-resident suppliers may also appoint local representatives to handle VAT registration, filing, and remittance. This law ensures that VAT is properly accounted for in digital transactions and online imports.

Sector Taxes

The Act also provides for the taxation of non-resident shipping and air transport companies whose ships or aircraft call at Nigerian ports. They are taxed on profits from transporting passengers, goods, mail, or livestock loaded in Nigeria, with a minimum tax of 2% of the gross Nigerian revenue which is payable monthly. Where the home country of the non-resident uses a similar tax basis, the taxable profits are determined using global profit and depreciation ratios applied to the Nigerian revenue

Double Taxation Relief

Double taxation relief applies where the Non-resident is liable to pay tax on the income from Nigeria in his home country and in Nigeria also. Where Nigeria has a double taxation agreement with the home country, the non-resident is entitled to tax credits up to the lower of the Nigerian tax to be paid or the foreign tax paid.

Collectively, these reforms create one of the most comprehensive cross-border tax frameworks Nigeria has ever implemented. For the global Nigerian, whether a diaspora professional, cross-border entrepreneur, or multinational investor, the message is clear: tax obligations are now defined not only by where you live, but also by where your economic presence lies. Understanding these rules and planning accordingly will be critical to remaining compliant, protecting wealth, and sustaining long-term financial confidence in Nigeria’s evolving tax landscape.

In the next part of this series, we will explore how the 2025 Tax Acts shape the taxation of trusts and estate structures with special attention to the creation, administration, distribution and liabilities for parties. Whether you’re managing a family trust, acting as a trustee, or standing to benefit from one, this next chapter promises practical insights into how the law now sees and taxes your trust.

PART 5

Welcome to Part 5 of our Tax Series focused on “My Trust, My Tax: What Every Settlor, Trustee, and Beneficiary Should Know about the Nigeria Tax Acts 2025”.

Trusts have long been recognised as powerful legal and financial tools for managing wealth, protecting assets, and ensuring continuity across generations. They are increasingly relevant to families, entrepreneurs, professionals, and institutions seeking structured solutions for succession, governance, and long-term planning.

The defining feature of a trust is the separation between legal ownership and beneficial enjoyment. The trustee holds legal title to the trust assets and is responsible for their management, while the beneficiaries are entitled to benefit from those assets, whether by way of income, capital, or use.

The enactment of the 2025 Tax Acts marks a decisive shift in how trusts and estates are treated within Nigeria’s tax framework. The new provisions are not merely technical; they are strategic, designed to ensure that trust structures do not become vehicles for tax leakage, income diversion, or opacity. For settlors, trustees, and beneficiaries alike, proper structuring and administration have never been more critical.

Trustee

Under Nigeria’s tax framework, a trust is generally recognised as a separate taxable arrangement, with the trustee positioned as the first point of contact for tax purposes. Income earned by a trust is assessed in the hands of the trustee in their representative capacity, and this includes income from all sources, whether local or foreign, reflecting Nigeria’s expanded approach to taxing worldwide income. In practical terms, the trust income is computed using standard income tax principles. Authorised expenses and fixed annuities are deductible, while profits arising from business activities, rents, or investments are adjusted in the same manner as those of an individual taxpayer.

The trustees are required to maintain proper records of trust income and expenses, file tax returns, and account for tax on income arising within the trust, where applicable. This responsibility exists regardless of whether the trustee is an individual or a corporate trustee and failure to comply with the rules may expose the trustee to penalties, interest, and personal liability in certain circumstances.

They also have an obligation to disclose the terms of the trust to the tax authorities when requested for. Companies that are created under a trust also have the same corporate tax rules that relate to companies discussed in part two of the series.

Trustees, as managers of trust assets which include real property, shares, digital assets, vehicles, etc, bear primary responsibility for computing, reporting, and paying tax on trust income and gains made from the transfer of those assets, declaring transfers at market value, and keeping proper records. The Act did clarify that gains from asset disposals by trustees are attributed to the beneficial owner, ensuring tax liability falls on the true recipient. This ensures that tax liability rests with the true economic recipient, even where trustees act as intermediaries.

Settlor

The Settlor rules have also changed. A key anti-avoidance feature of the new framework is the adoption of a robust “look-through” rule. Where a settlor retains control over a trust, through powers of revocation, entitlement to income, or other mechanisms, the income of the trust may be taxed directly in the hands of the settlor. The rule also applies where income is paid to an unmarried minor child above the national minimum wage, or in situations involving multiple settlors, where income is attributed in proportion to each settlor’s contribution. These provisions are designed to prevent artificial income splitting and ensure that tax liability cannot be avoided through family or trust arrangements that lack genuine economic separation.

Beneficiaries

Beneficiaries are taxed based on their rights and actual benefits under the trust. Fixed beneficiaries are taxed on their allocated share of trust income, while discretionary beneficiaries are taxed only when distributions are actually made to them. Any income distributed is taxed in the hands of the beneficiary, while undistributed income remains taxable on the trustee.

Where trust income is sourced from outside Nigeria and distributed to beneficiaries, the acts provide for proportional relief to mitigate double taxation. Importantly, with Nigerian residents now taxed on worldwide income, distributions from offshore trusts, foreign accounts, or overseas assets are no longer beyond the reach of Nigerian tax authorities.

The Nigeria Tax Acts 2025 reinforce an important message: trusts are not passive vehicles. They are active legal and tax arrangements that demand informed decision-making and ongoing compliance. Taken together, these reforms signal a new standard for trust governance in Nigeria, one grounded in transparency, accountability, and alignment with global tax norms. Trusts remain powerful tools for wealth preservation and succession, but only when supported by deliberate structuring, robust documentation, and proactive compliance.

For families and advisers, the message is clear: tax planning can no longer be treated as an afterthought. Trustees, settlors, and beneficiaries must now engage more deeply with the tax implications of their arrangements, ensuring that trusts achieve their intended objectives without creating unintended fiscal exposure.

In the next part of this series, we turn to the taxman’s expanding reach into the digital economy, examining the rules surrounding Digital Assets and other forms of online wealth.

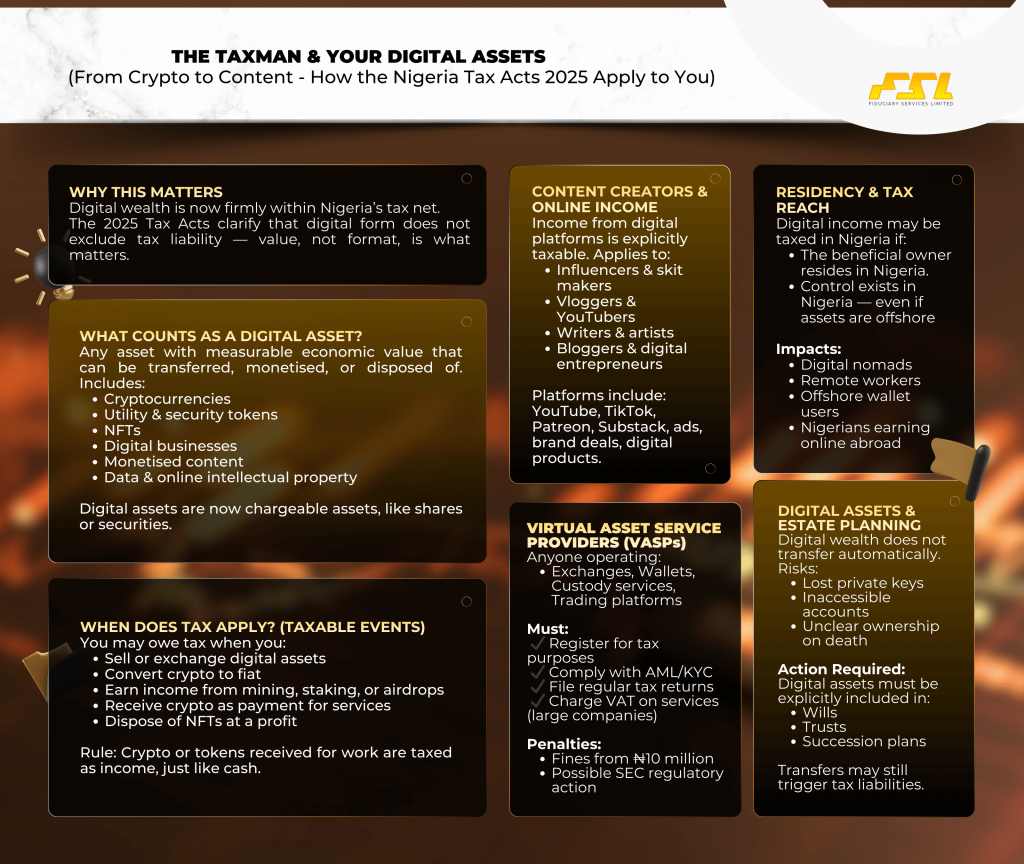

PART 6

Welcome to Part 6 of our Tax Series focused on “The Taxman and Your Digital Assets: From Crypto to Content—How the Nigeria Tax Acts 2025 Applies to You”.

In the previous part of this series, we examined how the Nigeria Tax Acts 2025 reshape the taxation of trusts, estates, and cross-generational wealth. This instalment turns to a newer but increasingly dominant form of value: digital assets and digital income.

For the modern techpreneur, wealth is no longer anchored to physical assets, bank accounts, or even traditional share certificates. It now resides in digital form, from cryptocurrencies and tokens to intellectual property, online businesses, data, and monetised content. Yet while innovation has accelerated, legal and succession planning around these assets has struggled to keep pace.

As Nigeria modernises its fiscal framework through the newly enacted acts, digital assets and new forms of income are squarely on the radar of tax authorities.

This article explains what the new tax regime means for you, whether you’re a crypto investor, a content creator, a business owner engaging with NFTs, or anyone earning income online.

Digital Assets Are Now Clearly Taxable

A central theme running through the Nigeria Tax Act 2025 (NTA 2025) is that form will no longer defeat substance. Where something has measurable economic value and can be transferred, monetised, or disposed of, the tax system will treat it as an asset or income stream, regardless of whether it exists on a blockchain, a platform dashboard, or a cloud server.

Under the NTA 2025, digital assets include cryptocurrency, utility tokens, security tokens, non-fungible tokens (NFTs), and similar representations of value that can be digitally exchanged. Digital assets are also treated as “chargeable assets” for purposes of tax on gains and this places them on the same conceptual footing as shares, securities, or other investment property.

Taxable Events: How and When You Owe Tax

The Tax Acts identify specific activities that trigger tax obligations. They include the sale or exchange of the digital assets, converting them to fiat money, and activities such as mining, staking, and airdrops, which can trigger taxes on the income made from such activities.

Also, where an individual is paid in cryptocurrency for work, creative content, consulting, or other services, that income is treated the same as if it were paid in cash, and it must be reported as income. Profit from selling NFTs is also taxed when you dispose of them for a gain, under the general capital gains or income tax rules, depending on the context of the transaction.

Content Income- Skit makers, influencers, Vloggers, Artistes, writers, e.t.c

Income derived from online content creation, including blogs, vlogs, social media monetisation, influencer partnerships, digital products, and ad revenue, is explicitly recognised as taxable under the broader income tax provisions of the new regime.

This is not a new tax, but a clarification that platform-based income has always been within the tax net. Earnings from platforms like YouTube, TikTok, Patreon, and Substack must therefore be reported annually, with tax payable where thresholds are exceeded. If such income exceeds applicable thresholds, you must report it and pay tax based on the rates in the NTA 2025. For digital creators running a structured business, Losses from their digital activities may also be deductible to the extent allowed by the law, offering some relief where there are genuine economic losses.

Virtual Asset Service Providers (VASPs)

Under the NTAA 2025, Anyone engaged in virtual asset activities such as exchanges, wallets, custody, or trading platforms must register as a Virtual Asset Service Provider (VASP) for tax purposes. These VASPs must comply with registration, reporting, AML/KYC protocols, and regular tax filings as non-compliance may attract significant penalties, including fines (e.g., ₦10 million initially) and potential regulatory action by the Securities and Exchange Commission (SEC). They are also liable to charge VAT on their services and not the digital assets itself, though this is restricted to large companies only.

This underscores that crypto and digital services are no longer informal or outside the regulatory tax net, even if the assets themselves remain decentralised.

Residency Rules

The new tax regime also makes clear that digital assets and income may be treated as located in Nigeria if the beneficial owner or controller resides in Nigeria, even if custody is offshore. This expands the tax reach to ensure residents can’t use foreign wallets or platforms alone to avoid tax.

This is particularly relevant for Nigerians working or earning abroad but with substantive ties to Nigeria, Digital nomads, remote freelancers, and content creators with Nigerian economic connections, and crypto holders who use offshore exchanges but retain control and beneficial interest.

Reporting and Compliance

For individuals, creators, and digital businesses, compliance under the 2025 regime requires more than filing returns. It demands intentional record-keeping, valuation discipline, and alignment between commercial reality and tax reporting. Individuals must maintain accurate records in naira, track digital transactions and declare gains annually, even where little or no tax is payable. Businesses and creators must formalise registrations, reflect digital income in their documentation, and obtain the required licences for virtual asset services. Across all categories, disciplined record-keeping and transparent reporting remain key to avoiding penalties.

Penalties for Non-Compliance

Failing to comply with these new tax provisions, especially for digital asset service providers, can result in administrative fines, heightened audits, or even SEC licence revocation for VASPs.

For individuals and creators, underreporting income or gains can trigger tax arrears, interest, and penalties under the general tax law. The evolving tax environment is pushing digital activity into formal oversight, not away from it.

Digital Assets and Estate Planning

Digital assets expose the limits of traditional estate planning if they are not deliberately addressed. Unlike physical or banked assets, digital wealth is controlled through private keys, platform access, and contractual rights that do not automatically pass under a will or trust. Under Nigeria’s 2025 tax framework, digital assets transferred on death or through trusts may trigger tax liabilities, while poor documentation risks permanent loss rather than inheritance. As a result, digital holdings must be expressly integrated into wills, trusts, and succession structures, with clear authority for executors or trustees. Digital wealth therefore, intensifies rather than replaces the need for disciplined, tax-efficient estate planning.

Conclusion

The inclusion of digital assets and digital income within Nigeria’s modernised tax framework reflects a broader policy direction and while this might feel like a new burden, the reforms are designed to provide clarity, close loopholes, and ensure that all forms of economically meaningful activity contribute fairly to national development. Whether you are investing in digital assets, creating content online, or building digital services, understanding your tax obligations early will help you grow sustainably, avoid risks, and stay compliant in a modernised regime.

In the next instalment of this series, we turn to philanthropy, examining what the Nigeria Tax Acts 2025 mean for donors, foundations, and non-profit organisations navigating tax compliance in a modern regulatory environment.

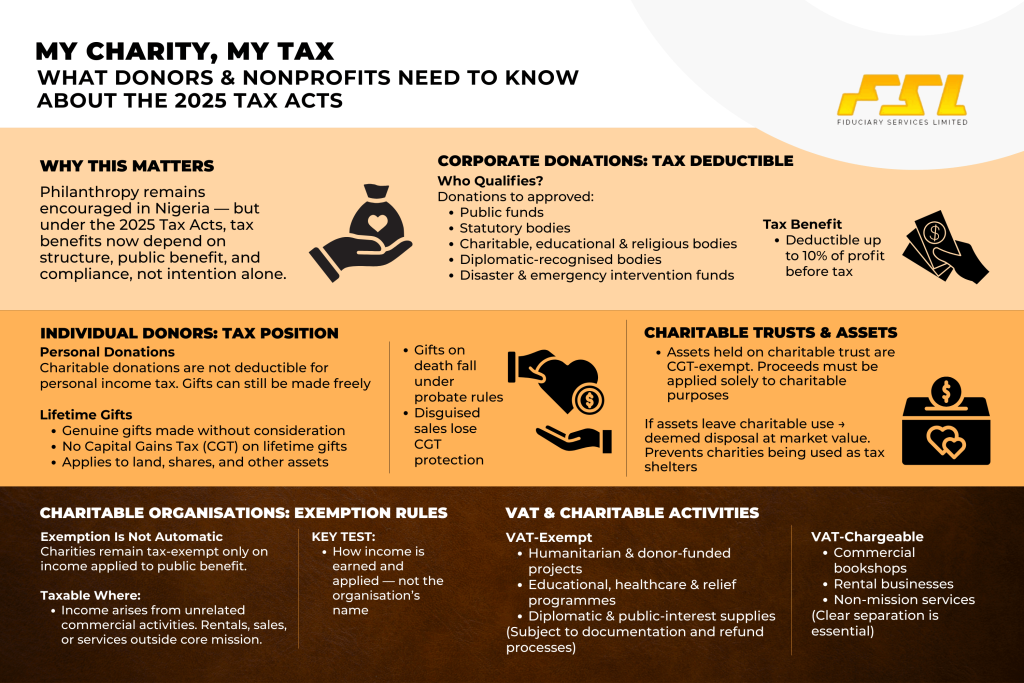

PART 7

Welcome to Part 7 of our Tax Series focused on “My Charity, My Tax: What Donors and Nonprofits Need to Know under the Nigeria Tax Acts 2025”.

Philanthropy in Nigeria has always been driven by generosity, faith, community, and social responsibility. However, under the newly enacted Tax Acts, charitable giving is no longer just about good intentions, it is also about structure, compliance, and documentation. The new tax framework makes one thing clear: While the Act continues Nigeria’s long standing support for charitable causes, it adopts a more disciplined approach that ties tax benefits strictly to structure, public benefit, and compliance.

Gifts by Individuals: Tax Neutral but Protected

For individual donors, the law takes a neutral approach. While individuals may make gifts or donations freely, charitable donations do not qualify as deductible expenses when computing personal income tax.

However, the Act preserves an important principle: lifetime gifts made without consideration do not attract capital gains tax. Where an individual disposes of an asset by way of a genuine gift, meaning no money or value is exchanged, the gain arising from that disposal is not chargeable to capital gains tax. This applies to a broad range of assets, including land, shares, and other forms of property. However, gifts made on death fall under a different regime and are excluded from this exemption(probate process).

This provision makes lifetime gifting an effective and tax-efficient tool for wealth transfer, whether to family members or charitable bodies. However, this protection applies only to true gifts. Transactions that involve consideration, or are structured to disguise a sale, fall outside this exemption.

Corporate Donations and Tax Deductibility

For corporate donors, the position is different. The NTA 2025 expressly encourages corporate philanthropy by permitting tax-deductible donations to approved public funds(set up by the government or a government body to finance a specific service or project), statutory bodies or institutions(created by an Act of Parliament), charitable, educational, or religious bodies, bodies recognised under the Diplomatic Immunities and Privileges Act(foreign envoys, and international organizations); or any pandemic, natural disaster or other public emergency interventions. Companies may deduct these donations of up to 10% of their profit before tax.

Donations may be made in cash or in kind. Where donations are made in kind, they must be properly valued, typically at the lower of market value or the amount paid for acquisition.

More importantly, companies must maintain comprehensive documentation, including receipts, acknowledgment letters, and evidence of the recipient’s approved charitable status. Without proper records, the deduction may be disallowed, regardless of the charitable intent behind the donation.

Charitable Organisations: Exemption Is Not Automatic

Under the Acts, organisations established for religious, charitable, educational, or benevolent purposes and operating for public benefit continue to enjoy income tax exemptions. However, this exemption is strictly limited to income that is not derived from commercial or unrelated business activities. Where a nonprofit earns income from trade or business outside its core mission, such as rentals for profit, sales, or services not directly linked to its charitable purpose, that income becomes taxable.

The key test is no longer the organisation’s name or registration status, but how it earns and applies its income. Charities must be able to show that their funds are applied exclusively toward public benefit. Where commercial activities exist, clear separation between charitable and taxable income streams is essential.

Record-Keeping and Reporting: A New Compliance Reality

One of the most significant shifts under the NTA and NTAA 2025 is the emphasis on transparency. The charity’s tax-exempt status does not remove compliance obligations. Charitable organisations are required to maintain proper books of account, track donations and expenditures, and file annual returns demonstrating that funds were used for charitable purposes.

Failure to keep records or file returns may result in penalties or, more seriously, the withdrawal of tax-exempt status. In effect, the new Acts treat nonprofits as accountable institutions, not informal benevolent bodies.

VAT and Charitable Activities: Not All Supplies Are Exempt

The Acts also clarify the VAT treatment of charitable activities. Goods and services supplied directly in furtherance of humanitarian donor funded projects, such as educational programmes, healthcare outreach, or humanitarian relief are generally exempt from VAT provided that the humanitarian donor shall first pay the VAT and then request a refund from the Service. This is where proper documentation becomes relevant. The goods or services supplied to a diplomatic mission, diplomat or person recognised under the Diplomatic Immunities and Privileges Act whose activity is in public interest, and not for profit are also VAT exempt.

However, where a charitable organisation supplies goods or services outside its core mandate, such as operating a commercial bookshop or rental business, those transactions may attract VAT.

Charitable organisations must therefore clearly separate mission-related activities from commercial ones. Proper segregation ensures that VAT exemptions are applied correctly and reduces the risk of regulatory exposure.

Record-Keeping, Reporting, and Compliance Obligations

Importantly, tax exemption does not eliminate compliance obligations. Even tax-exempt charitable organisations are required to maintain detailed books of account showing how income and donations are received and applied. They must also file annual returns and reports demonstrating that funds were used exclusively for charitable purposes.

Where an organisation engages in both charitable and commercial activities, it must clearly distinguish between taxable and non-taxable income streams. Failure to maintain transparency, proper records, or timely filings may result in penalties or the withdrawal of exempt status

Charitable Trusts and Asset Protection

The NTA 2025 also safeguards assets held in trust for religious or charitable institutions of a public character. Gains arising from the disposal of such assets are exempt from tax, provided the assets are not connected to a trade or business and any proceeds are applied solely toward charitable objectives. Where property ceases to be held on charitable trust, the law imposes a deemed disposal at market value, ensuring that charitable structures are not used as vehicles for tax avoidance. This ensures that charitable exemptions are preserved only for genuine philanthropic use and not as a tax shelter. Trustees must therefore manage charitable assets with discipline and clear accountability.

Conclusion: Charity with Structure

The Nigeria Tax Acts 2025 do not discourage philanthropy, but they professionalise it. Donors are encouraged to give with awareness, and nonprofits are expected to operate with clarity, discipline, and transparency. Tax benefits now follow public benefit, proper structure, and compliance, not sentiment alone.

For donors, the lesson is simple: understand the tax consequences of how and through whom you give. For nonprofits, the message is even clearer: charity may be voluntary, but compliance is not.

In this new tax era, sustainable philanthropy is no longer just about doing good, it is about doing good the right way.

As part of our Wealth Preservation services, we have experienced Advisors ready to assist you in developing an estate plan that protects, preserves, and sustains you and your family’s wealth for generations.

Get in touch with one of our professionals today by sending an email to contact@fiduciaryservicesltd.com.