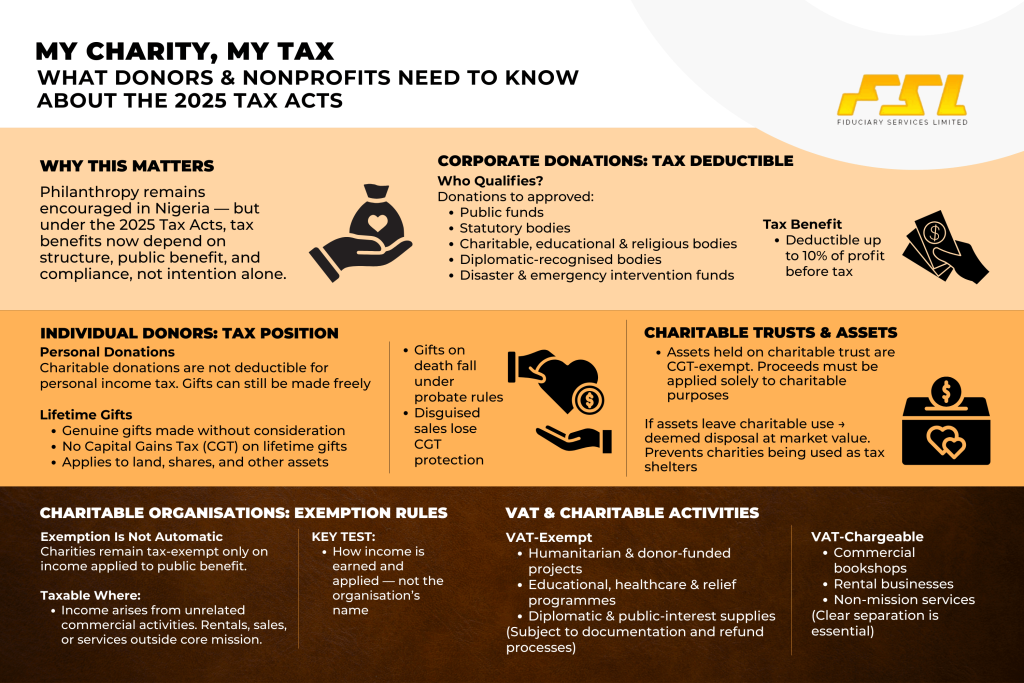

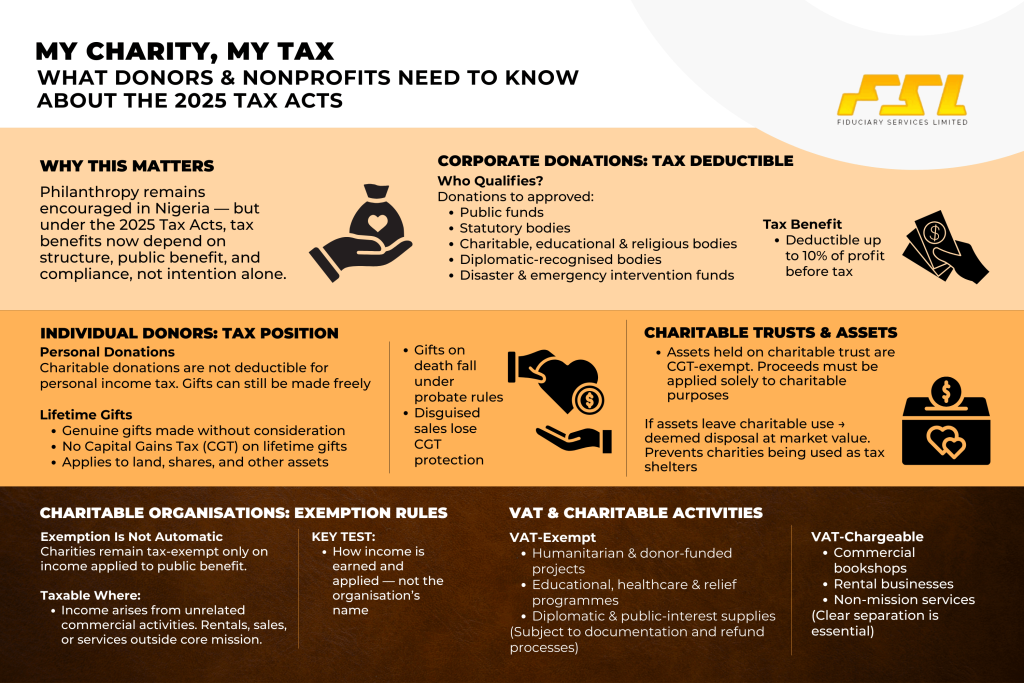

Welcome to Part 7 of our Tax Series focused on “My Charity, My Tax: What Donors and Nonprofits Need to Know under the Nigeria Tax Acts 2025”.

Philanthropy in Nigeria has always been driven by generosity, faith, community, and social responsibility. However, under the newly enacted Tax Acts, charitable giving is no longer just about good intentions, it is also about structure, compliance, and documentation. The new tax framework makes one thing clear: While the Act continues Nigeria’s long standing support for charitable causes, it adopts a more disciplined approach that ties tax benefits strictly to structure, public benefit, and compliance.

Gifts by Individuals: Tax Neutral but Protected

For individual donors, the law takes a neutral approach. While individuals may make gifts or donations freely, charitable donations do not qualify as deductible expenses when computing personal income tax.

However, the Act preserves an important principle: lifetime gifts made without consideration do not attract capital gains tax. Where an individual disposes of an asset by way of a genuine gift, meaning no money or value is exchanged, the gain arising from that disposal is not chargeable to capital gains tax. This applies to a broad range of assets, including land, shares, and other forms of property. However, gifts made on death fall under a different regime and are excluded from this exemption(probate process).

This provision makes lifetime gifting an effective and tax-efficient tool for wealth transfer, whether to family members or charitable bodies. However, this protection applies only to true gifts. Transactions that involve consideration, or are structured to disguise a sale, fall outside this exemption.

Corporate Donations and Tax Deductibility

For corporate donors, the position is different. The NTA 2025 expressly encourages corporate philanthropy by permitting tax-deductible donations to approved public funds(set up by the government or a government body to finance a specific service or project), statutory bodies or institutions(created by an Act of Parliament), charitable, educational, or religious bodies, bodies recognised under the Diplomatic Immunities and Privileges Act(foreign envoys, and international organizations); or any pandemic, natural disaster or other public emergency interventions. Companies may deduct these donations of up to 10% of their profit before tax.

Donations may be made in cash or in kind. Where donations are made in kind, they must be properly valued, typically at the lower of market value or the amount paid for acquisition.

More importantly, companies must maintain comprehensive documentation, including receipts, acknowledgment letters, and evidence of the recipient’s approved charitable status. Without proper records, the deduction may be disallowed, regardless of the charitable intent behind the donation.

Charitable Organisations: Exemption Is Not Automatic

Under the Acts, organisations established for religious, charitable, educational, or benevolent purposes and operating for public benefit continue to enjoy income tax exemptions. However, this exemption is strictly limited to income that is not derived from commercial or unrelated business activities. Where a nonprofit earns income from trade or business outside its core mission, such as rentals for profit, sales, or services not directly linked to its charitable purpose, that income becomes taxable.

The key test is no longer the organisation’s name or registration status, but how it earns and applies its income. Charities must be able to show that their funds are applied exclusively toward public benefit. Where commercial activities exist, clear separation between charitable and taxable income streams is essential.

Record-Keeping and Reporting: A New Compliance Reality

One of the most significant shifts under the NTA and NTAA 2025 is the emphasis on transparency. The charity’s tax-exempt status does not remove compliance obligations. Charitable organisations are required to maintain proper books of account, track donations and expenditures, and file annual returns demonstrating that funds were used for charitable purposes.

Failure to keep records or file returns may result in penalties or, more seriously, the withdrawal of tax-exempt status. In effect, the new Acts treat nonprofits as accountable institutions, not informal benevolent bodies.

VAT and Charitable Activities: Not All Supplies Are Exempt

The Acts also clarify the VAT treatment of charitable activities. Goods and services supplied directly in furtherance of humanitarian donor funded projects, such as educational programmes, healthcare outreach, or humanitarian relief are generally exempt from VAT provided that the humanitarian donor shall first pay the VAT and then request a refund from the Service. This is where proper documentation becomes relevant. The goods or services supplied to a diplomatic mission, diplomat or person recognised under the Diplomatic Immunities and Privileges Act whose activity is in public interest, and not for profit are also VAT exempt.

However, where a charitable organisation supplies goods or services outside its core mandate, such as operating a commercial bookshop or rental business, those transactions may attract VAT.

Charitable organisations must therefore clearly separate mission-related activities from commercial ones. Proper segregation ensures that VAT exemptions are applied correctly and reduces the risk of regulatory exposure.

Record-Keeping, Reporting, and Compliance Obligations

Importantly, tax exemption does not eliminate compliance obligations. Even tax-exempt charitable organisations are required to maintain detailed books of account showing how income and donations are received and applied. They must also file annual returns and reports demonstrating that funds were used exclusively for charitable purposes.

Where an organisation engages in both charitable and commercial activities, it must clearly distinguish between taxable and non-taxable income streams. Failure to maintain transparency, proper records, or timely filings may result in penalties or the withdrawal of exempt status

Charitable Trusts and Asset Protection

The NTA 2025 also safeguards assets held in trust for religious or charitable institutions of a public character. Gains arising from the disposal of such assets are exempt from tax, provided the assets are not connected to a trade or business and any proceeds are applied solely toward charitable objectives. Where property ceases to be held on charitable trust, the law imposes a deemed disposal at market value, ensuring that charitable structures are not used as vehicles for tax avoidance. This ensures that charitable exemptions are preserved only for genuine philanthropic use and not as a tax shelter. Trustees must therefore manage charitable assets with discipline and clear accountability.

Conclusion: Charity with Structure

The Nigeria Tax Acts 2025 do not discourage philanthropy, but they professionalise it. Donors are encouraged to give with awareness, and nonprofits are expected to operate with clarity, discipline, and transparency. Tax benefits now follow public benefit, proper structure, and compliance, not sentiment alone.

For donors, the lesson is simple: understand the tax consequences of how and through whom you give. For nonprofits, the message is even clearer: charity may be voluntary, but compliance is not.

In this new tax era, sustainable philanthropy is no longer just about doing good, it is about doing good the right way.

As part of our Wealth Preservation services, we have experienced Advisors ready to assist you in developing an estate plan that protects, preserves, and sustains you and your family’s wealth for generations.

Get in touch with one of our professionals today by sending an email to contact@fiduciaryservicesltd.com.