Welcome to Part 6 of our Tax Series focused on “The Taxman and Your Digital Assets: From Crypto to Content—How the Nigeria Tax Acts 2025 Applies to You”.

In the previous part of this series, we examined how the Nigeria Tax Acts 2025 reshape the taxation of trusts, estates, and cross-generational wealth. This instalment turns to a newer but increasingly dominant form of value: digital assets and digital income.

For the modern techpreneur, wealth is no longer anchored to physical assets, bank accounts, or even traditional share certificates. It now resides in digital form, from cryptocurrencies and tokens to intellectual property, online businesses, data, and monetised content. Yet while innovation has accelerated, legal and succession planning around these assets has struggled to keep pace.

As Nigeria modernises its fiscal framework through the newly enacted acts, digital assets and new forms of income are squarely on the radar of tax authorities.

This article explains what the new tax regime means for you, whether you’re a crypto investor, a content creator, a business owner engaging with NFTs, or anyone earning income online.

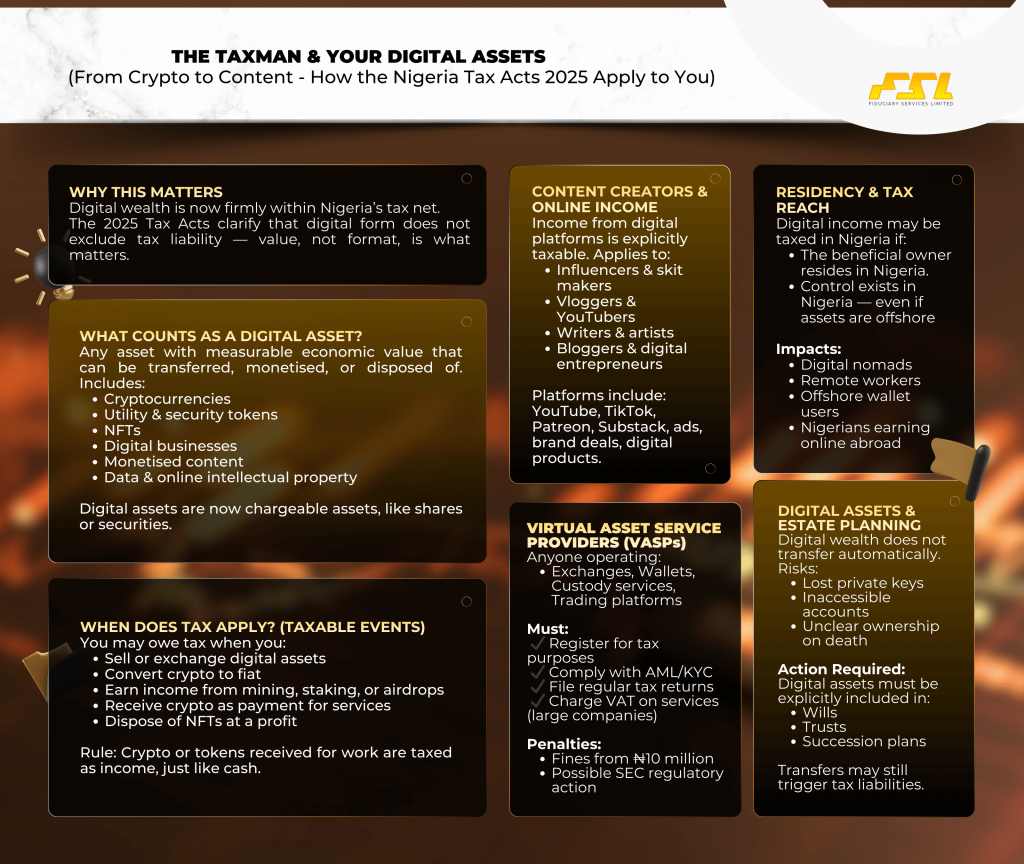

Digital Assets Are Now Clearly Taxable

A central theme running through the Nigeria Tax Act 2025 (NTA 2025) is that form will no longer defeat substance. Where something has measurable economic value and can be transferred, monetised, or disposed of, the tax system will treat it as an asset or income stream, regardless of whether it exists on a blockchain, a platform dashboard, or a cloud server.

Under the NTA 2025, digital assets include cryptocurrency, utility tokens, security tokens, non-fungible tokens (NFTs), and similar representations of value that can be digitally exchanged. Digital assets are also treated as “chargeable assets” for purposes of tax on gains and this places them on the same conceptual footing as shares, securities, or other investment property.

Taxable Events: How and When You Owe Tax

The Tax Acts identify specific activities that trigger tax obligations. They include the sale or exchange of the digital assets, converting them to fiat money, and activities such as mining, staking, and airdrops, which can trigger taxes on the income made from such activities.

Also, where an individual is paid in cryptocurrency for work, creative content, consulting, or other services, that income is treated the same as if it were paid in cash, and it must be reported as income. Profit from selling NFTs is also taxed when you dispose of them for a gain, under the general capital gains or income tax rules, depending on the context of the transaction.

Content Income- Skit makers, influencers, Vloggers, Artistes, writers, e.t.c

Income derived from online content creation, including blogs, vlogs, social media monetisation, influencer partnerships, digital products, and ad revenue, is explicitly recognised as taxable under the broader income tax provisions of the new regime.

This is not a new tax, but a clarification that platform-based income has always been within the tax net. Earnings from platforms like YouTube, TikTok, Patreon, and Substack must therefore be reported annually, with tax payable where thresholds are exceeded. If such income exceeds applicable thresholds, you must report it and pay tax based on the rates in the NTA 2025. For digital creators running a structured business, Losses from their digital activities may also be deductible to the extent allowed by the law, offering some relief where there are genuine economic losses.

Virtual Asset Service Providers (VASPs)

Under the NTAA 2025, Anyone engaged in virtual asset activities such as exchanges, wallets, custody, or trading platforms must register as a Virtual Asset Service Provider (VASP) for tax purposes. These VASPs must comply with registration, reporting, AML/KYC protocols, and regular tax filings as non-compliance may attract significant penalties, including fines (e.g., ₦10 million initially) and potential regulatory action by the Securities and Exchange Commission (SEC). They are also liable to charge VAT on their services and not the digital assets itself, though this is restricted to large companies only.

This underscores that crypto and digital services are no longer informal or outside the regulatory tax net, even if the assets themselves remain decentralised.

Residency Rules

The new tax regime also makes clear that digital assets and income may be treated as located in Nigeria if the beneficial owner or controller resides in Nigeria, even if custody is offshore. This expands the tax reach to ensure residents can’t use foreign wallets or platforms alone to avoid tax.

This is particularly relevant for Nigerians working or earning abroad but with substantive ties to Nigeria, Digital nomads, remote freelancers, and content creators with Nigerian economic connections, and crypto holders who use offshore exchanges but retain control and beneficial interest.

Reporting and Compliance

For individuals, creators, and digital businesses, compliance under the 2025 regime requires more than filing returns. It demands intentional record-keeping, valuation discipline, and alignment between commercial reality and tax reporting. Individuals must maintain accurate records in naira, track digital transactions and declare gains annually, even where little or no tax is payable. Businesses and creators must formalise registrations, reflect digital income in their documentation, and obtain the required licences for virtual asset services. Across all categories, disciplined record-keeping and transparent reporting remain key to avoiding penalties.

Penalties for Non-Compliance

Failing to comply with these new tax provisions, especially for digital asset service providers, can result in administrative fines, heightened audits, or even SEC licence revocation for VASPs.

For individuals and creators, underreporting income or gains can trigger tax arrears, interest, and penalties under the general tax law. The evolving tax environment is pushing digital activity into formal oversight, not away from it.

Digital Assets and Estate Planning

Digital assets expose the limits of traditional estate planning if they are not deliberately addressed. Unlike physical or banked assets, digital wealth is controlled through private keys, platform access, and contractual rights that do not automatically pass under a will or trust. Under Nigeria’s 2025 tax framework, digital assets transferred on death or through trusts may trigger tax liabilities, while poor documentation risks permanent loss rather than inheritance. As a result, digital holdings must be expressly integrated into wills, trusts, and succession structures, with clear authority for executors or trustees. Digital wealth therefore, intensifies rather than replaces the need for disciplined, tax-efficient estate planning.

Conclusion

The inclusion of digital assets and digital income within Nigeria’s modernised tax framework reflects a broader policy direction and while this might feel like a new burden, the reforms are designed to provide clarity, close loopholes, and ensure that all forms of economically meaningful activity contribute fairly to national development. Whether you are investing in digital assets, creating content online, or building digital services, understanding your tax obligations early will help you grow sustainably, avoid risks, and stay compliant in a modernised regime.

In the next instalment of this series, we turn to philanthropy, examining what the Nigeria Tax Acts 2025 mean for donors, foundations, and non-profit organisations navigating tax compliance in a modern regulatory environment.

We invite you to join our exclusive webinar on the 2025 Tax Acts, titled “Era of Transparency: Nigeria’s redefined Tax Regime” bringing together experts to unpack practical tax insights for individuals, families, and businesses.

Register early to secure your spot and be part of the discussion shaping Nigeria’s new tax future.

As part of our Wealth Preservation services, we have experienced Advisors ready to assist you in developing an estate plan that protects, preserves, and sustains you and your family’s wealth for generations.

Get in touch with one of our professionals today by sending an email to contact@fiduciaryservicesltd.com.