Welcome back to our series on “The Wealthy Matriarch”. In this edition, we will be discussing “Women and Money”.

Money serves as more than just a medium of exchange, it is also a representation of value and a means to make “perceived value” tangible and interchangeable.

Beyond the above, money holds symbolic significance, acting as a status indicator, a means to attain desires, and even a societal divider and for women, a sense of security.

Money is often used as a representation of value or worth, hence self-worth can be equated with net worth. Low income sometimes manifests in low self-worth and, sometimes overcompensation with money could be a sign of low self-worth, that is, the use of money to boost your esteem. More often, money is the end result and representation that we trade our life energy to attain.

It is essential to recognize that money is not equal to wealth; true wealth encompasses an abundance beyond monetary measures.

In this newsletter, we will be considering unconscious money beliefs and biases that women harbour; how women relate to money (financial agency); the difference between how men and women think about money, as well as women and retirement planning.

Unconscious Programming/Limiting Money Beliefs

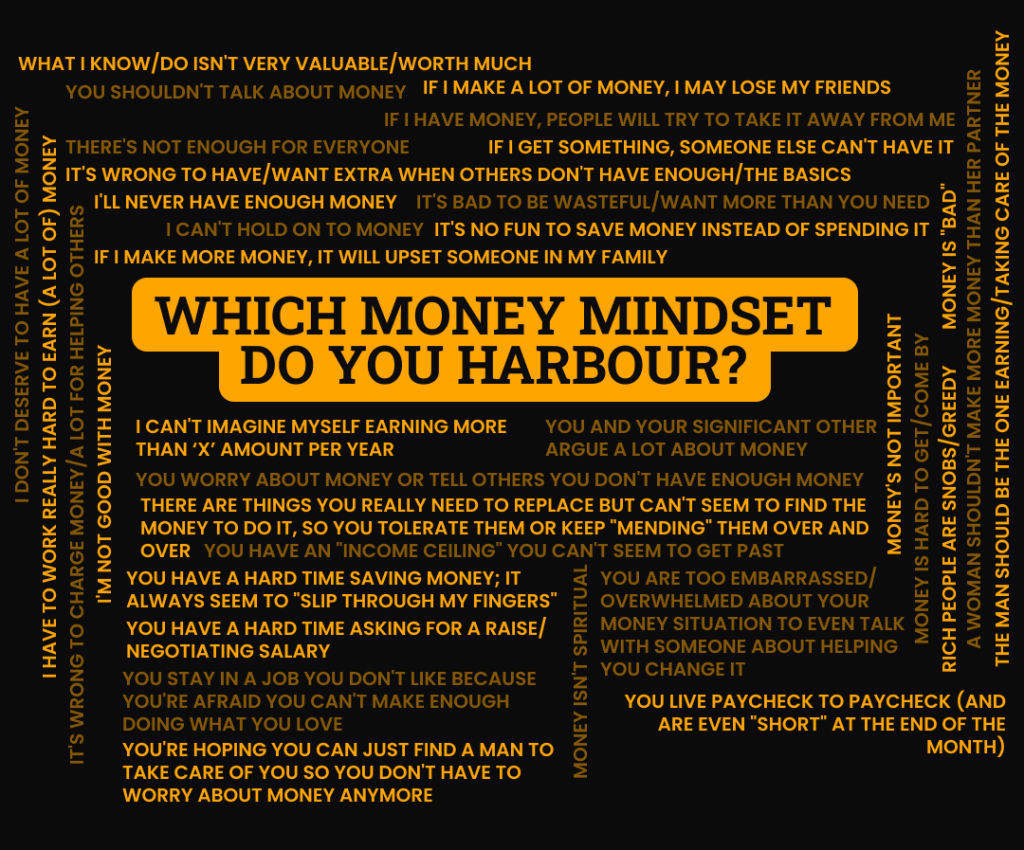

There are unconscious money beliefs that unfortunately many people grow up with. Some of these are as a result of gender bias, environmental factors, and influence. Below are some stereotypes about money that women may harbour, which in turn limits them from getting wealthy.

Which money mindset do you harbour?

In our Wealth Webinar 3.0, Sabila Din noted the challenges and biases women might face in the wealth management landscape. She identified nine (9) biases women face including the gender pay gap; investment bias by financial advisors causing a gap in wealth creation; longevity; caregiving responsibilities when they have to take time off work to be with family and that impacts wealth; underrepresentation in the financial services, legacy and estate planning; they may face challenges in estate planning due to gender roles; risk aversion (women are more risk averse and may not utilize portfolio); cultural and societal norms; access to resources, particularly when it comes to the creation of wealth; and access to finance, network and new market. You can listen to Sabila here.

The first step in challenging these biases and overcoming the obstacles is awareness. There is a need to be aware that things are not as they should be, and only after this, can conscious efforts be made to navigate the biases and defy stereotypes.

Lack of training and knowledge can be resolved through training, reading relevant books, attending seminars and webinars, and having these conversations among groups of friends.

How Men and Women Think About Money

The stereotypes and biases are reflected in how men and women think about money. Men tend to exhibit more confidence in their financial abilities compared to women. Conversely, women report feeling more anxiety about their financial situations, and this stems from various factors such as the gender pay gap mentioned earlier, societal expectations, and historical financial inequalities. Women were only allowed into the workforce in the last few decades.

Men are also more proactive in negotiating their salaries compared to women, a factor that has contributed to the persistent gender pay gap. The lower percentage of women negotiating their salaries also reflects the unconscious programming and limiting money belief resulting in the discomfort with advocating for their worth in the workplace.

Men are interested in investing and entrepreneurship, whereas women lean more towards savings and frugality. This difference in interests may stem from societal norms and expectations regarding risk-taking and financial responsibility.

As a woman, it is imperative that you ask yourself these questions:

- What do I think I am worthy of?

- How much do I think I am worth?

- Do I unconsciously have an income ceiling?

- Do I think I should not have too much money as a woman?

- Do I have a limit to my earnings?

- Why do I place a limit on my spending?

- How much do I think is acceptable for me to spend?

- Do I think it is acceptable for me to handle my own money or leave it to the men in my life to handle?

- Am I afraid of making more than my partner or spouse?

By recognizing the difference between how women and men think about money, and challenging the stereotypes and biases, women can be on the path to financial agency.

Financial agency refers to the sense of control one feels over their finances and the ability to influence and have faith in their ability to handle their finances. Financial empowerment is essential for women to assert control over their economic lives, pursue their aspirations, and achieve long-term stability. And for this, women need education, mentorship, and support. Women also need to leverage technology.

Women and Retirement Planning

Statistics have shown that over 70% of women retire without a plan and only about one in four retire with any significant retirement savings.

Retirement planning is a necessity for everyone. For women, several factors come into play when it comes to retirement planning. The gender pay gap, interruptions in career paths due to caregiving responsibilities, and longer life expectancies can significantly impact women’s ability to save for retirement and their financial security in later years.

To address these challenges, women should take proactive steps to secure their financial futures:

- Start Saving Early: Women need to prioritize saving for retirement as soon as possible, even if they can only contribute small amounts initially. The power of compounding can help their savings grow over time.

- Maximize Retirement Contributions: Take advantage of employer-sponsored retirement plans and contribute enough to qualify for any employer matching contributions. Consider additional retirement savings vehicles.

- Plan for Career Interruptions: Recognize the potential impact of career interruptions due to caregiving responsibilities and plan accordingly. Explore options such as flexible work arrangements, remote work, or job-sharing to sustain career progression while balancing caregiving duties.

- Educate Yourself: Take the time to educate yourself about retirement planning, investment strategies, and financial literacy. Seek out resources, workshops, or financial advisors who can provide guidance tailored to women’s unique needs and circumstances.

- Advocate for Change: Support efforts to address systemic issues such as the gender pay gap and workplace policies that disproportionately affect women’s ability to save for retirement. Advocate for policies that promote gender equality in the workforce and provide support for caregivers.

A question often asked about women and retirement planning is “How much is needed for retirement?” The truth about this is that there is no straight answer. Factors such as location, healthcare needs, dependents, lifestyle, and life expectancy will determine how much a person needs for retirement. Since women have a longer lifespan than men, it is advisable that they save more towards their retirement.

In conclusion, the relationship between women and money is complex, and influenced by societal norms and personal beliefs. Overcoming unconscious biases and stereotypes is the first step towards financial empowerment. Understanding the differences in how men and women approach money is essential for fostering confidence and planning for the future. By prioritizing savings, advocating for change, and educating themselves, women can take control of their financial destinies and achieve long-term security. It’s time to challenge the status quo, empower women in finance, and create a more equitable financial landscape for all.

As part of our Private Client services, we have experienced Trust and Estate Planning Advisors ready to assist you in developing an estate plan that protects, preserves, and sustains you and your family’s wealth for generations.

Get in touch with one of our professionals today by sending an email to contact@fiduciaryservicesltd.com

You may also find the following Articles to be insightful: