Preserving your Family Wealth Legacy

We are

Private Client Professionals

We provide contemporary, bespoke and holistic Private Client Services including Estate & Legacy Planning, Trusteeship/Asset Custodial, Family Business Advisory & Governance, Islamic Estate Planning and Wealth Preservation Solutions.

10

Professional Services

75+

Combined Years of Experience

0+

Age of clients for tailored services

Your Concerns,

Our Solutions

“ Planning for my loved one's and family’s future feels overwhelming at times—there’s so much to consider, from protecting our properties, assets and businesses to instiling our family values as well as preparing for the unexpected. I want to create a plan that offers clarity, stability, comfort, and peace of mind for my loved ones, but I’m not sure where to begin or how to address all my concerns and the complexities that exist. How can set up an estste plan that truly secures my family’s future and puts my mind at peace, even when life throws curveballs? “

Peace of Mind

We offer more than just estate planning solutions; we work with you to simplify complexities, provide assurance, confidence, and make certain your peace of mind. Our services are personalised and specific to protect what is most valuable to you, your family, assets, and legacy.

As your Private Client Advisors, we design bespoke plans that align with your concerns, goals and aspirations. With meticulous attention to detail, we help you achieve the clarity to focus on what truly matters to you. Let us help you navigate life’s challenges with precision and poise, so you can focus on creating lasting memories with the ones you love.

View All SolutionsWe offer more than just estate planning solutions; we work with you to simplify complexities, provide assurance, confidence, and make certain your peace of mind. Our services are personalised and specific to protect what is most valuable to you, your family, assets, and legacy.

As your Private Client Advisors, we design bespoke plans that align with your concerns, goals and aspirations. With meticulous attention to detail, we help you achieve the clarity to focus on what truly matters to you. Let us help you navigate life’s challenges with precision and poise, so you can focus on creating lasting memories with the ones you love.

“As a family with several businesses, we have worked hard to build wealth, but it’s becoming clear that we need to take cognisance of the health, happiness, and personal aspirations of all family members. How can we create harmony between our wealth and overall well-being?"

Well-Being

True wealth is a balance of financial success and personal well-being. At the intersection of financial success and personal wellbeing lies our holistic approach to wealth management.

We prioritize the alignment of you and your family’s financial goals with critical considerations of the intellectual, social, spiritual and human assets within your family. Together, we will create a future where you and your family's wealth and well-being are in perfect harmony.

View All SolutionsTrue wealth is a balance of financial success and personal well-being. At the intersection of financial success and personal wellbeing lies our holistic approach to wealth management.

We prioritize the alignment of you and your family’s financial goals with critical considerations of the intellectual, social, spiritual and human assets within your family. Together, we will create a future where you and your family's wealth and well-being are in perfect harmony.

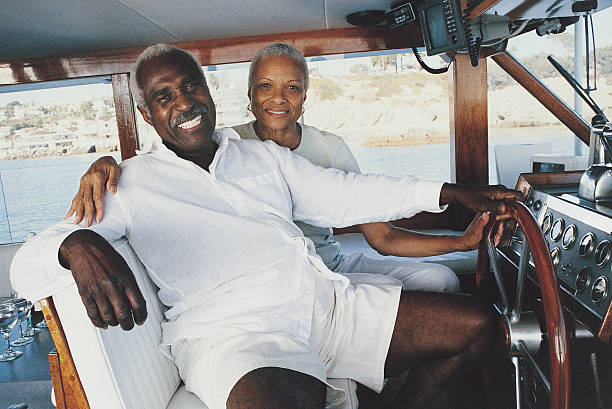

“ I have anxiety and concerns about how we can bond as a family. It seems we increasingly have more differences than what binds us together as a family. Staying connected feels like a challenge, with busy schedules and different priorities, tending to children, young adults and grandchildren, how can we bond as a family and ensure our family remains connected across generations? “

Family Play.

In today's hectic society, it’s easy for families to drift apart, but shared stories and experiences can bridge gaps and reinforce bonds. Our approach emphasizes the value of espousing meaningful traditions, shared values and purpose that bring families closer. From motivating family gatherings, prompting collective family projects to facilitating open discussions about what matters most to family members, we are here to help you and your family not just preserve its wealth but also family bond and harmony that truly makes it enduring.

Let us help you build a family culture where laughter, understanding, and shared purpose thrive—laying the foundation for a legacy that’s as connected as it is enduring.

View All SolutionsIn today's hectic society, it’s easy for families to drift apart, but shared stories and experiences can bridge gaps and reinforce bonds. Our approach emphasizes the value of espousing meaningful traditions, shared values and purpose that bring families closer. From motivating family gatherings, prompting collective family projects to facilitating open discussions about what matters most to family members, we are here to help you and your family not just preserve its wealth but also family bond and harmony that truly makes it enduring.

Let us help you build a family culture where laughter, understanding, and shared purpose thrive—laying the foundation for a legacy that’s as connected as it is enduring.

My family and I have accumulated significant assets and wealth, but I have concerns with long-term stewardship and well-being of our family wealth. How can we harness our wealth to fully sustain our family’s legacy across generations while balancing growth, governance and family alignment/harmony.

Harnessing Your Wealth.

As your fiduciary, we understand wealth, especially multi-generational family wealth as a holistic composition of qualitative and quantitative components. For all our clients, we participate actively in the realization of their most cherished goals by working with them to preserve their families wealth and legacy across generations.

View All SolutionsAs your fiduciary, we understand wealth, especially multi-generational family wealth as a holistic composition of qualitative and quantitative components. For all our clients, we participate actively in the realization of their most cherished goals by working with them to preserve their families wealth and legacy across generations.

At Fiduciary Services Ltd , we handle the management, transfer and distribution of your assets, applying various estate planning tools customized to suit your wishes and existing peculiarities. We work with our clients to develop bespoke solutions that effectively address their specific contemporary concerns on Wealth Management, Legacy Planning, and the security of their family/dependents’ future.

What's Your Concern?

Newsletters

Welcome to the March 2026 edition of our Malaudu Thawah newsletter.Throughout the month of March,...

Every year on March 8, the world celebrates International Women’s Day, recognising the remarkable achievements of...

Industry

News

No Visa! The U.S. Immigration Pause and What It Means for Global Mobility Strategy

Sunday, January 18th, 2026

The U.S. State Department has announced a sweeping new policy: immigrant visa processing will be suspended for citizens of 75 countries beginning January 21, 2026. The move is framed as an effort to restrict access for individuals deemed likely to rely on public assistance and it will halt decisions on new immigrant visas until further reassessment of screening procedures.

U.S. EMBASSY WARNS NIGERIANS OF FRAUDULENT DOCUMENTATION

Sunday, December 28th, 2025

The U.S. Embassy and Consulate in Abuja have issued a stern warning regarding the severe consequences of visa fraud, explicitly stating that providing falsified information or submitting fake documents can result in permanent visa bans.

Green Card Lottery Suspension: What the U.S. Diversity Immigrant Visa (Green Card Lottery) Suspension Means for Nigerians and Globally Mobile Families

Sunday, December 28th, 2025

For decades, the United States Diversity Immigrant Visa (DV) Programme, commonly known as the Green Card Lottery, has been one of the most accessible gateways to U.S. permanent residence. Its appeal lies in its simplicity: no employer sponsorship, no family petition, and no investment threshold.

Global Mobility & Immigration: Matters Arising

Monday, December 22nd, 2025

The United States of America (US) has red-flagged several countries by fully banning their citizens from travelling or even obtaining an immigration visa into the US and partially restricted travel from several more countries. On the 16th of December 2025, President Donald Trump issued a new Proclamation which expands the scope of...

Nigeria’s Exit from the FATF Grey List: A Turning Point for Global Mobility, Cross-Border Wealth and HNI Opportunity

Monday, December 1st, 2025

Nigeria’s removal from the Financial Action Task Force (FATF) grey list marks a major inflection point for the nation’s economic credibility, global financial visibility and the mobility of its citizens. For years, being on the grey list branded Nigeria as a...

Global Family Business Think Tank 2025 Report Unveiled: Insights from the global family business community on family business matters that will help shape family business discussions and strategies

Thursday, November 27th, 2025

The Family Business United has officially released its Global Family Business Think Tank—Summer 2025 report, an in-depth publication offering important perspectives on the evolving landscape of family enterprises across the world. Drawing on the collective expertise of 122 contributors from over 30 countries, including...

Trump Signs Proclamation Adding $100K Annual Fee for H-1B visa Applications

Monday, September 29th, 2025

On the 23rd of September 2025, the Trump administration introduced a new annual fee of $100,000 for H-1B visa applications. The H-1B visa is a U.S. work permit that enables companies to employ foreign professionals in specialized fields such as information technology, healthcare, and engineering. These measures will fundamentally change access to...

Qatar Bars Nigerian Men Travelling Alone from Obtaining Tourist, Transit Visas

Monday, September 15th, 2025

Nigerian men travelling alone will no longer be eligible for tourist or transit visas to Qatar, following new rules introduced by the Gulf nation’s Ministry of Interior. The decision, which Qatari authorities say is aimed at curbing overstays, took effect around September 5, 2025, and applies to...

Singapore Still Holds the Crown as the World’s Most Powerful Passport

Thursday, July 24th, 2025

In a recent report by the Henley Passport Index, Singapore still holds the top spot as the world’s most powerful passport, granting visa-free access to an unprecedented 193 destinations out of 227. This year's rankings, powered by ....

Maldives Launches First Residence by Investment Program

Friday, July 11th, 2025

The Maldives is taking a bold step beyond its idyllic beaches and luxury resorts by opening its doors to global investors seeking more than just a vacation. In partnership with Henley & Partners, the island nation has officially...