In the world of opulence, there is a need to navigate the delicate balance between family dynamics, harmony, and financial success. This is where the concept of “Rooms and Hats” come in, serving as a guide when there is concern about how to manage family dynamics.

If you missed our previous editions, you can catch up on them here.

Recognizing The Dynamics Within Families

“Family dynamics” refers to the ways in which members of a family interact with one another. These interactions can be greatly impacted by learned behaviors, roles, or hierarchy within the family, culture, and customs. Family dynamics are very significant to wealthy individuals because they impact how family members navigate the social, psychological, and emotional spheres within a family wealth system. Family dynamics would manifest in the roles and responsibilities, communication styles, dispute resolution techniques, money issues, financial literacy, personal boundaries, and parenting styles of family members.

“Rooms and Hats”

HNWIs should develop comprehensive estate plans that include wills, trusts, and powers of attorney. A will outlines how your assets should be distributed after death, while trusts can protect your assets during your lifetime and ensure they are managed according to your wishes. Powers of attorney can authorize a trusted individual to make decisions on your behalf in the event of incapacitation.

Compartments of Life: “Rooms”

Think of your life as a lavish home with several rooms.

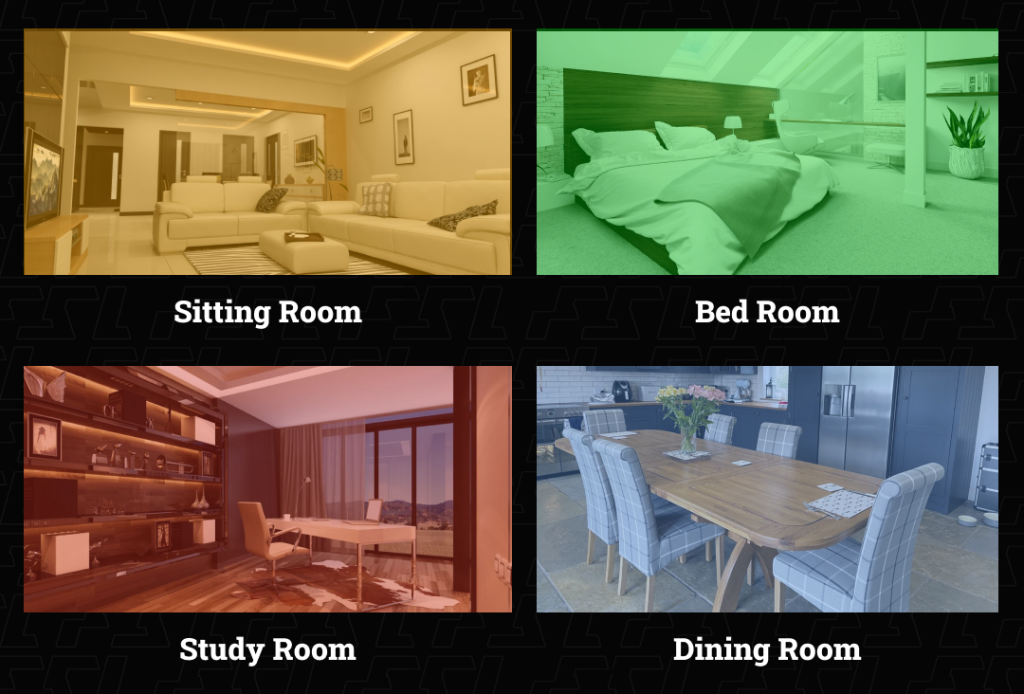

Each room represents a different aspect, such as family, career, or personal objectives. Rooms are environments with distinct roles and expectations that require people to behave in particular ways. One may readily picture the living room, bedroom, dining room, and other spaces in the family as gathering places for family members, but there are other rooms as well, like the family office, where it is appropriate to have an operator, manager, or leader. Other rooms that come to mind include the boardroom and the directorial rooms.

Roles and Responsibilities: “Hats”

Hats are a symbol for the different identities, roles, and responsibilities that people assume in different contexts of their lives.

These can be informal (such as friendship, wife, mother, etc.) or formal (such as being the president, CEO, or manager of a company).

Hats have a huge impact on our interactions, expectations, and behaviors. Knowing what hat one is wearing at any given moment is crucial. Is it the hat of a president, ownership, CEO, parent, or stakeholder, among others? At all times, the hat you are wearing should be identifiable to a second person. The majority of people do not know that we all wear different hats as individuals, and in their ignorance, they wear many hats simultaneously. It is crucial to know when to wear each type of hat, because doing so will make things easier and more comfortable. If you wear two different types of hats in the same setting, it could be disastrous. It is imperative to know which hat to wear in which setting because, as one might imagine, an informal hat in a formal setting would not look appropriate. Furthermore, it should be possible for second parties to discern who is speaking at any given moment—is it the CEO, the father, the wife, etc.? It facilitates people’s ability to structure discussions and prevent misunderstandings.

When it comes to families in the business world, it can be challenging to pull off certain hats. Most family members who take on responsibilities have a hard time navigating the informal hat because they do not want to look weak in front of other family members, which can be extremely stressful. Now think about all the different roles people play in families. Every role in life is like a different hat: Philanthropist, Business leader, Board Chairman, Chief Executive, Spouse, Parent, Sister, Brother, Uncle, In-law etc. It is important to wear each hat with purpose and attention. When putting on the business hat, the focus is on making professional and strategic decisions. The emphasis switches to creating deep bonds and shared experiences when putting on the familial hat.

Making sure that each role is understood within the relevant settings (rooms, – rooms, family dinner tables, etc.) and avoiding overlap are key components of the art of managing “hats.” The deliberate understanding and acknowledgment by every family member of the roles (per time) and the transition between roles avoids the problem that wealthy individuals often face—that is, the blurring of personal, business, and professional life.

To begin managing rooms and hats, one of the most important things to do is to be self-aware, recognize and define your own hats and rooms, and then, once they have been defined, determine which room and when to wear each hat.

Creating Family Harmony

To facilitate family harmony and mitigate the tensions and conflicts that may arise, the following may be useful:

1. Boundaries:

It is critical to delineate boundaries between personal, business, and family affairs. By doing this, the possibility of tension or conflict transferring from one domain to another is avoided. Establishing clear boundaries between family members is pivotal to limiting the impact of dysfunctional family dynamics and helps to facilitate and preserve wholesome relationships. Families with defined boundaries foster an atmosphere where people feel free to express their opinions. When establishing limits, family members should consider their own needs, values, and limitations. Determine what conversations, behaviors, or situations make one another comfortable.

2. Communication:

Clear and honest communication is what keeps the different rooms and hats together. Frequent family meetings and conversations about expectations can improve harmony and understanding. A healthy family is dependent on open and constructive dialogue, which is the foundation of effective communication. It strengthens the ties that bind the family together and promotes understanding. On the other hand, ineffective communication can plant the seeds of misinterpretation and engender animosity. There is also the need to allow for different perspectives from every member of the family. One thing that hinders individuals from progressing to the next step in terms of managing rooms and hats is not having access to information.

3. Financial Literacy:

It is important for family members to have relevant and requisite financial knowledge and understanding. Open dialogue regarding money issues and the obligations associated with riches (being wealthy) fosters understanding among all parties. Finances in the family can bring about a lot of conflict. It is critical to readily understand and comprehend how family finances are managed and controlled; to do this, open communication with all parties involved must be encouraged. It is possible that not every family member has the same degree of financial literacy; hence, inequalities in knowledge about the complexities of family assets and wealth can result in misunderstandings and, occasionally, exploitation. For the purpose of encouraging a collaborative and knowledgeable approach to financial decisions, closing this knowledge gap is imperative.

4. Utilising Experts:

It is essential to work with advisors to secure the legal, financial, and strategic advice required when dealing with family dynamics. Advisors can offer knowledge and experience to help navigate the peculiar difficulties such wealthy families face

YOU MAY FIND THIS HELPFUL

The second edition of our webinar series with the theme: Conversations on Wealth Management: Trends and Dynamics Shaping the Lives and Legacies of the Affluent and High Net-worth Individuals (HNIs) was held on 10th August, 2023.

The discussions centered on issues arising with respect to Family Dynamics, Philanthropy, Sustainability, mental Incapacity, and Digital assets planning for affluent and wealthy families.

We have provided this report as a synthesis of insights and learnings from our panel of experts. Enjoy reading!

As part of our Private Client services, we have experienced Trust and Estate Planning Advisors ready to assist you in developing an estate plan that protects, preserves, and sustains you and your family’s wealth for generations.

Get in touch with one of our professionals today by sending an email to contact@fiduciaryservicesltd.com

You may also find the following newsletters to be insightful:

1. How can HNWIs protect themselves and their wealth in the event of Mental Incapacitation?

2. Conversations on Wealth Management: Mental Incapacity

3. 7 Ages of High-Net-worth Individuals (HNWIs) and Family Age 7: Legacy and Wealth Transfer